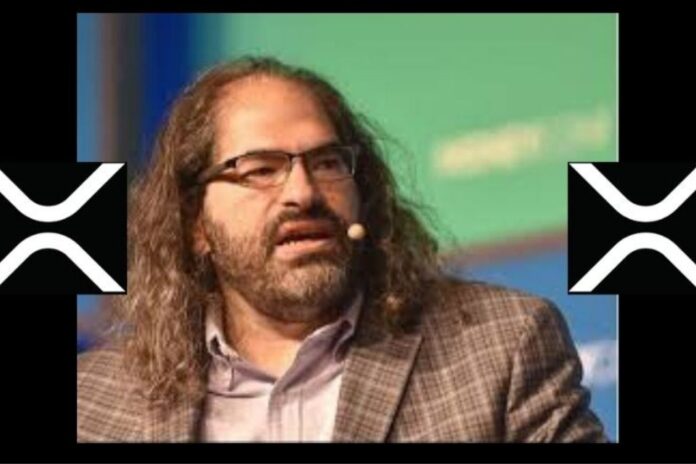

David Schwartz, the chief technical officer at Ripple, has recently explained why the San Francisco-based cross-border payment firm chose not to pressure all its customers on RippleNet to use the digital token XRP.

Ripple currently has over 300 notable customers across the world. And the fact that many of these customers limit their activities to RippleNet has become a thing of concern within the XRP ecosystem.

Read Also: Credible Crypto: XRP Is Destined To Reach Somewhere Between $20 and $30 in This Bull Cycle

Many banks and financial institutions on Ripple’s network don’t desire to leverage the utility embedded in XRP, such as scalability, speed, and cost-efficiency, for a reason best known to them.

No Customers Will Desire To Stay With Ripple If They Are Pressured

In a conversation with Roshan Mirajkar shared by the popular XRP-centric YouTuber, CryptoEri, David Schwartz explained why Ripple chose not to impose XRP on its customers that are on RippleNet.

According to Ripple CTO, the firm will lose many viable customers if it adopts such a strategy. He, however, stated that the strategy adopted by the firm gives clients a vast array of choices.

Read Also: Flare Networks Is Set To Airdrop another Token to XRP Holders. Who Are Those Eligible? Details

David Schwartz noted:

“We don’t want to pressure people to use the solution seen as the best solution for them. The question is “Why not pressure everybody on Ripplenet to use XRP?” We probably wouldn’t have any customers if we did that. Like you can’t tell your customers to use things that benefit you and don’t benefit them. The strategy I think has to be to give people a vast array of choices.”

Why not pressure everybody on Ripplenet to use XRP?

"We probably wouldn't have any customers if we did that."

Strategy: A vast array of choices.

David Schwartz CTO Ripple, August 16, 2021@Bitboy_Crypto pic.twitter.com/5cHzN7Raat— CryptoEri 130k+ Followers (beware of imposters) (@sentosumosaba) August 28, 2021

Expectedly, the short video posted by CryptoEri garnered a lot of reactions and prompted a user to ask of an option that is currently better than using XRP, considering the use cases embedded in it.

Read Also: Ripple Announces New On-Demand Liquidity (ODL) In Japan

The user wrote, “Doesn’t make sense. How does using XRP not benefit the customer? What option is better than using XRP?”

In response to the user’s concern, CryptoEri said:

“XRP is designed to eliminate Nostro accounts where trillions are tied up in Correspondent Banking Model (you can more about this downside on BIS website). XRP acts as liquidity, reducing FX cost & friction moving fiat to fiat. The new loan option for FI’s is also a benefit.”

Follow us on Twitter, Facebook, Telegram, and Download Our Android App