Ethereum transaction fee-burning mechanism has removed more than 2.6 million ETH from the circulating supply since it came into effect in August. Ether token burning was enabled upon approval of EIP-1559, which came alongside the successful London hardfork implementation.

To move ETH to become a deflationary asset, and overhaul the Ethereum network’s transaction fee market and other parameters, including gas refunds, the London hardfork was implemented many months ago. The crucial upgrade also ushered in the Ethereum Improvement Proposal (EIP) 1559.

High transaction fees are among the problems of the popular blockchain network. Therefore, EIP-1559 was rolled out and it centered on reforming the Ethereum gas fee market, by modifying the transaction fee limit and also introducing a token burning feature.

With this burn feature, a portion of Ether’s total supply is removed from circulation permanently when any transaction takes place on the blockchain.

Read Also: Over 13.3 Million ETH Now Staked in Ethereum 2.0 Contract as The Merge Nears

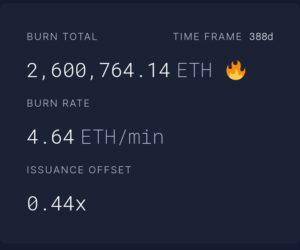

According to data from Ultra Sound Money, 2,600,764.14 ETH has been burned or removed from Ether’s circulating supply, at the time of writing. Data also shows that 4.64 ETH is being burned per minute. It is speculated that more token burning, which leads to a reduced circulating supply would further boost the price of Ethereum.

Outstanding decentralized platforms contributing hugely to this massive ETH burning include OpenSea, Uniswap V2, Tether, Otherdeed, MetaMask, and many more. It is worth noting that over 239,705.89 ETH have been taken out of circulation courtesy of gas fees from ETH transfers.

While OpenSea, the leading NFT marketplace has contributed a total of 230,049.97 ETH and counting to the total burn volume recorded ever since the implementation of EIP-1559.

Read Also: Billionaire Mark Cuban Joins Ethereum Merge Backers, Says He’s Bullish on ETH

Ethereum (ETH) has been steadily experiencing a decrease in price over the last couple of days despite the forthcoming upgrade. At the time of filing this report, Ethereum is trading for $1,452.66, recording a decline of over 7% in the last 7 days, according to Coinmarketcap data.

The long-awaited upgrade is designed to transition the largest smart contract platform to a proof-of-stake (PoS) mechanism. The aim is to make running the network less energy-intensive as opposed to the current proof-of-work (PoW) mechanism.

The merge is crucial because it’s coming to set the stage for further scalability features and upgrades. The Ethereum co-founder Vitalik Buterin noted that after the Merge, the network would only be 55% complete.

Therefore, certain issues like high gas fees and transaction speed would not substantially improve after the Merge upgrade on September 16.

Follow us on Twitter, Facebook, Telegram, and Google News

In a market brimming with anticipation, Pi Network (PI) is once again in the spotlight.…

Ever felt like you missed the boat on the last big meme coin? With the…

Analysis reveals that ADA token supporters face an unpleasant fact because research dismisses the possibility…

Crypto Eri (@sentosumosaba), a respected figure in the cryptocurrency community, recently highlighted concerns regarding CME…

American entrepreneur Patrick Bet-David has recently sparked new interest in XRP’s potential to disrupt traditional…

Ripple’s CEO, Brad Garlinghouse, has expressed enthusiasm about the upcoming launch of XRP futures on…