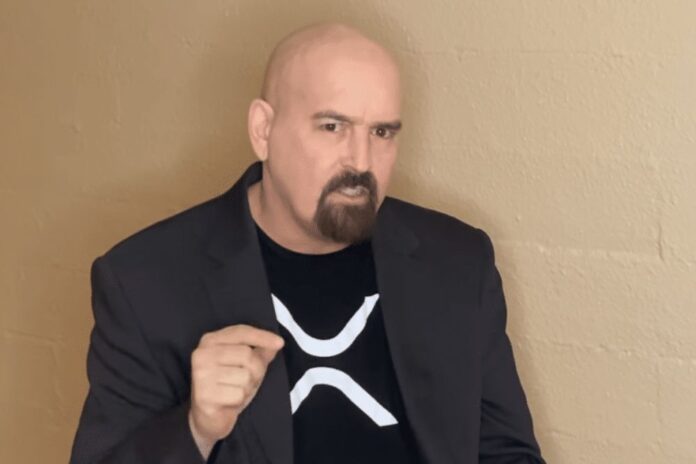

John Deaton, the renowned crypto proponent and the attorney representing over 75k XRP holders in the ongoing Ripple-SEC lawsuit, believes the SEC would launch a court battle against more crypto projects in the future as the agency continues its regulation of the nascent industry by enforcement.

Reiterating a claim he made six months ago, John Deaton noted that the SEC’s agenda to sue a top crypto exchange for selling unregistered securities could result in a 50% crypto market crash.

“Gensler would sue a major exchange or two for selling unregistered securities. I believe it, even more, today because it could cause another 50% crash. Then incumbents take a larger share,” he wrote.

6 months ago on @FoxBusiness w/@cvpayne @LizClaman @CGasparino @EleanorTerrett I said that Gensler would sue a major exchange or two for selling unregistered securities. I believe it even more today because it could cause another 50% crash. Then incumbents take a larger share.

— John E Deaton (@JohnEDeaton1) December 4, 2022

Over the years, the securities watchdog has engaged in different legal tussles with several blockchain companies, on the claims that tokens sold to investors were unregistered securities. Ripple and LBRY are the most Notable among these projects currently.

Related: Why the SEC Won’t Win Ripple in the XRP Lawsuit, Attorney Jeremy Hogan Explains

While the SEC recently defeated LBRY in the LBC case, the San Francisco-based crypto solutions firm is fighting hard to prove that XRP is not a security and that Ripple didn’t commit any securities fraud. Accordingly, John Deaton explained why the XRP lawsuit would not end like the LBRY-SEC case.

The staunch XRP supporter further implied that Gary Gensler is all-out to attack the crypto industry, citing that the SEC chair nearly doubled the workforce of the Division of Enforcement’s Crypto Assets and Cyber Unit in May.

Deaton wrote, “some of us have been saying Gary Gensler and the SEC was coming after crypto for 2 years. He literally doubled the size of the SEC staff dedicated to crypto and pushed regulation by enforcement in non-fraud cases like Ripple, LBRY, Dragonchain, and BlockFi, to name a few.”

“The SEC is the 2nd largest creditor in the BlockFi bankruptcy for God’s sake. That fact alone speaks volumes regarding intent. Ask yourself what registration requirements were implemented w/the $100M BlockFi settlement? How did it improve industry practices?” he added.

But from the perspective of the SEC chair, the regulatory agency is only seeking to better protect investors from bad actors in the crypto industry. Also, he

that the increase in Cyber Unit size has successfully brought more cases against those seeking to hurt investors in the crypto market.

Follow us on Twitter, Facebook, Telegram, and Google News