The team at Arcane Research recently released a report on the collapse of the Terra blockchain, which led to the crash of the algorithmic stablecoin TerraUSD (UST) and the LUNA token.

The report starts by comparing the Terra ecosystem to a sinking cruise ship: “If the Terra Ecosystem was a sinking cruise ship, the captain and distinguished guests fled in superyachts, leaving most passengers behind without lifeboats.”

“If the Terra Ecosystem was a sinking cruise ship, the captain and distinguished guests fled in superyachts, leaving most passengers behind without lifeboats.”

New piece by @andershelseth https://t.co/iRMQyrBKNC

— Arcane Research (@ArcaneResearch) May 30, 2022

Read Also: Terraswap DEX Launches on Terra 2.0 As More Projects Move to the New Chain

Terra Classic (LUNC) Supply Controlled By a Few Holders, Who Sold Before the Crash

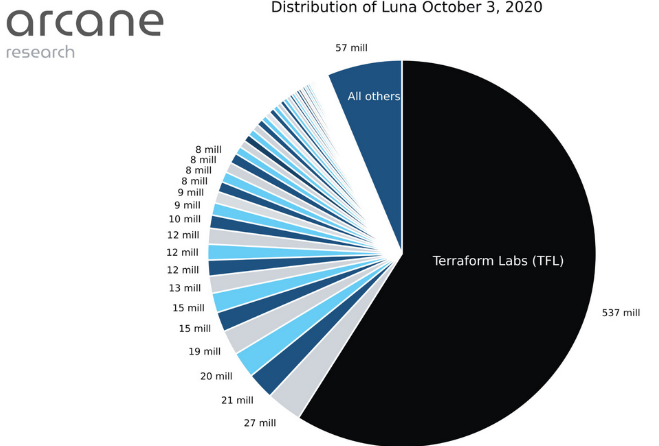

Moreover, the report compared the Terra fiasco to a standard pump-and-dump scheme with Terra Classic supply held by a few holders and Terraform Labs, the firm behind the Terra blockchain, led by Do Kwon, as highlighted by Arcane Research in the image below:

The report added that from October 2020 to May 5th, 2022, 3,000 Terra wallet clusters had a net outflow of $6 billion worth of LUNA to exchanges via bridges. Within the same period, all other hundreds of thousands of wallets recorded a net inflow of $6.5 billion, which indicates a pattern of selling LUNA tokens by large holders to retail investors. All these played out before the tragic crash.

TerraUSD (UST) Provided Perfect Exit Liquidity Similar to a Prolonged Pump and Dump

The team at Arcane Research also pointed out that the burn and mint mechanisms surrounding the TerraUSD (UST) and LUNA provided the “perfect way to create sustained exit liquidity for their initial endowment of LUNA tokens.”

How does burn/mint mechanism work in the Terra ecosystem? “With certain limitations, a user could convert 1 dollar worth of LUNA to 1 UST by burning the LUNA, and vice versa.

“In theory, if I owned all LUNA tokens, I could drive up prices on the exchanges by buying my own tokens, then mint a great amount of UST while at the same time reducing the LUNA supply through the burn/mint mechanism.”

Read Also: Kraken CEO Defends His Exchange’s Decision to List Terra (LUNA 2.0)

So, the surge in the price of LUNA in the fall of 2021 enabled the large holders to convert their tokens into great amounts of UST.

At the same time, the 20% yield guaranteed by the Anchor protocol and reserve backing by Terraform Labs, created significant demand for UST making it easy for the large LUNA holders to cash out by minting UST and selling into the Anchor-induced demand for the stablecoin.

The team at Arcane Research explained how the flow of profits into the wallets of early LUNA holders was thereby guaranteed:

“By pumping the LUNA token, the burn/mint mechanism, and creating a sustained demand for the UST token through Anchor, the perfect exit liquidity for large LUNA bags was created.

“And the UST exit gates were used at scale for a set of very early LUNA holders. At best, the profits can be described as collateral winnings in a failed bootstrapping attempt.”

Follow us on Twitter, Facebook, Telegram, and Google News