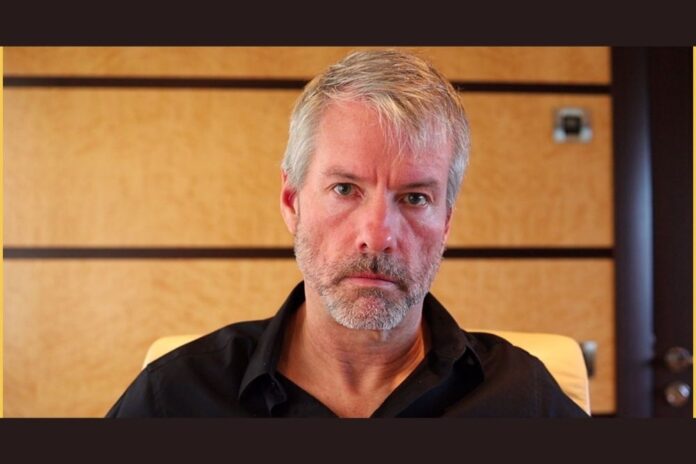

Michael Saylor, founder and former CEO of MicroStrategy, has highlighted the reason behind the sale of Bitcoin (BTC) initiated by the company towards the end of 2022.

In a recent discussion on Twitter, Saylor stated that MicroStrategy as a corporation has the right to enjoy tax benefits through the sale of a portion of his Bitcoin holdings.

Read Also: Billionaire Mark Cuban States the Condition That Can Make Him Buy More Bitcoin (BTC)

Michael Saylor noted:

“Bitcoin is traded as property right now, so that means that you can sell the property, take the capital loss and you have the option to buy property in the future or to have bought it in the past and that’s a different tax basis.

“We have some capital gains that we pay taxes on and then we can have some capital losses in Bitcoin, so by selling the Bitcoin and taking the capital loss, we’re able to use that to offset some capital gains. So it’s very tax efficient for the corporation.”

It can be recalled that in a filing submitted on the 28th of December to the United States Securities and Exchange Commission (SEC), MicroStrategy reported that it sold $11.8 million worth of Bitcoin (BTC) at an average price of approximately $16,776 on December 22nd.

According to the company in the filing, the sale of about 704 BTC is for tax purposes.

“MicroStrategy plans to carry back the capital losses resulting from this transaction against previous capital gains, to the extent such carrybacks are available under the federal income tax laws currently in effect, which may generate a tax benefit.”

Read Also: Crypto Veteran Bobby Lee Predicts When Bitcoin Bear Market Would End. Here’s His Timeline

The firm also shows in the filing that it bought more BTC on the 24th of December than it sold:

“On December 24, 2022, MicroStrategy acquired approximately 810 Bitcoins for approximately $13.6 million in cash, at an average price of approximately $16,845 per Bitcoin, inclusive of fees and expenses.”

Follow us on Twitter, Facebook, Telegram, and Google News