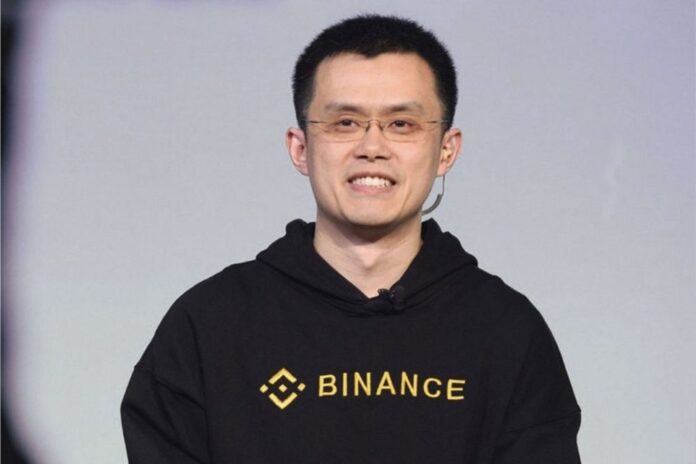

Changpeng Zhao (CZ), the CEO of Binance, the world’s largest crypto exchange by trading volume, has branded Sam Bankman-Fried (SBF) one of the greatest fraudsters in history following the collapse of the FTX exchange that left over a million creditors with nothing to hold.

In a thread of tweets on the 6th of November where he shared his opinion on the sudden implosion of FTX last month, CZ said SBF is also a “master manipulator when it comes to media and key opinion leaders.”

Read Also: Binance CEO To Crypto Community: Bitcoin (BTC) Is Not Dead. We Are Still Here

Binance CEO also disclaimed the accusation of destroying the imploded exchange with his tweet on November 6 when he announced that he would liquidate Binance’s holdings of FTT.

“No healthy business can be destroyed by a tweet. However, there was a tweet that may have, Caroline’s tweet 16 minutes after mine on Nov 6. Data shows it was the real cause for people to dump FTT,” he said, referring to a Twitter post from Caroline Ellison, the former CEO of FTX’s sister trading firm, Alameda Research.

CZ added that “SBF perpetuated a narrative painting me and other people as the “bad guys”. It was critical in maintaining the fantasy that he was a “hero.” SBF is one of the greatest fraudsters in history, he is also a master manipulator when it comes to media and key opinion leaders.

On Binance’s competition with FTX, he wrote, “We don’t focus on competitors because it’s a waste of time and resources when the industry has only touched 6% of the population. We want multiple exchanges, multiple blockchains, multiple wallets, etc, to co-exist in the ecosystem.”

Others Who Blamed Sam Bankman-Fried for FTX Collapse

Other crypto exchange CEOs have also condemned Bankman-Fried and criticized the response to FTX’s collapse, including that media have been too sympathetic towards the disgraced former executive.

Kraken CEO Jesse Powell called out Bankman-Fried a week ago following the latter’s appearance on a Twitter space, saying he was “completely full of shit about how margin trading works.”

“He’s saying that the whole exchange operated on a net account equity model and anybody could borrow anything (in any amount?) from client funds or from nowhere. That’s not how it should work,” Powell said.

The following day he added that he didn’t believe Bankman-Fried set out to hurt people.

“I think he just didn’t care or he was recklessly overconfident. It doesn’t matter though. What matters is he knew he was gambling with his clients’ money,” he said.

Coinbase CEO Brian Armstrong also said he finds it baffling that Bankman-Fried has not been arrested for defrauding creditors.

Follow us on Twitter, Facebook, Telegram, and Google News