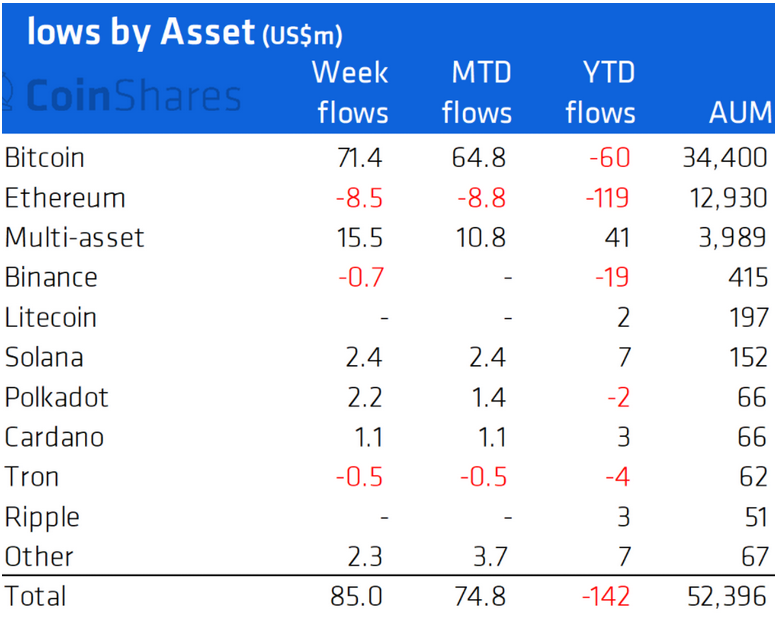

Crypto asset manager CoinShares reported that the recovery trend showcased by the crypto market last week resulted in notable institutional investments inflows for many top cryptocurrencies. However, Ethereum (ETH), the second-largest crypto by market cap, lags behind once again.

According to the latest Digital Asset Fund Flows Weekly report, the flagship cryptocurrency, Bitcoin (BTC), recorded the largest share of institutional investments last week.

Read Also: Messari: Polkadot (DOT) Was the Asset of Choice for Institutional Investors In 2021

CoinShares noted:

“Bitcoin continues to lead the inflows with US$71m last week, the largest since early December with this 3-week run of inflows totaling US$108m. Volumes in Bitcoin investment products remained low last week at US$1.8bn versus US$3.4bn the previous week.”

Institutional Inflows into Cardano, Solana, Polkadot

In the report, it’s shown that top Ethereum competitors, including Solana (SOL), Polkadot (DOT), Terra (LUNA), and Cardano (ADA), saw institutional investments inflows totaling, $2.4 million, $2.2 million, $1.4 million and $1.1 million.

As for Terra (LUNA), this was its first week of recording such significant institutional investments inflows.

Read Also: CoinShares: Ethereum and Cardano Dominate Inflows to Institutional Crypto Investment Products

On the other hand, the largest smart contracts platform, Ethereum (ETH), extended its weeks of outflows to nine, after losing $8.5 million in institutional investments last week.

“Investment products flows for Ethereum suggest investors remain bearish with outflows of US$8.5m, having entered the 9th week run of outflows totaling US$280m…”

Follow us on Twitter, Facebook, Telegram, and Google News