The increasing popularity of decentralized and non-traditional payment schemes is prompting significant changes in the financial sector. As customers begin to embrace these alternative methods, institutions are adapting by making it easier for their customers to transfer value into and out of these new systems.

SMQKE (@SMQKEDQG), a prominent figure in the XRP community, shared a page from a report by the World Economic Forum highlighting this trend, citing Ripple as a pivotal example of an alternative rail that can enhance traditional payment systems.

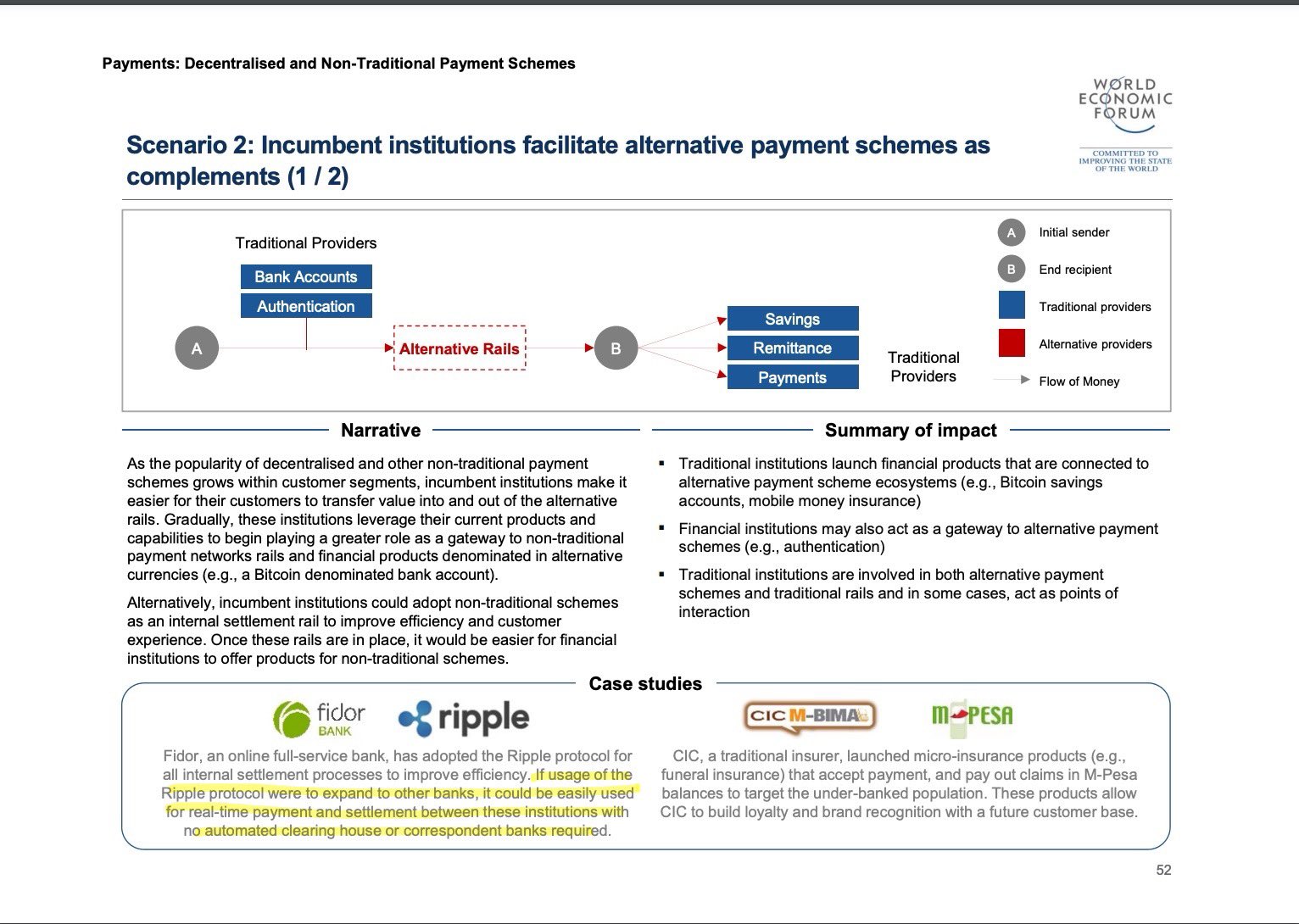

“If usage of the Ripple protocol were to expand to other banks, it could be EASILY used for real-time payment and settlement BETWEEN these institutions with NO automated clearing house or correspondent banks required.”

Integration of Alternative Payment Rails

As traditional financial institutions seek to maintain relevance, they are exploring ways to integrate alternative payment systems. The report outlines a scenario where these institutions can leverage existing products and capabilities to serve as gateways to non-traditional payment networks instead of building their systems from scratch.

The integration of these systems allows financial institutions to offer enhanced services, reach out to new users, appeal to customers who want change, and retain their customer base.

These institutions can streamline operations, reduce costs, and improve customer experience by adopting alternative payment rails. The report mentions Ripple as a transformative protocol that can facilitate real-time payment and settlement between institutions.

Ripple as a Transformative Protocol

Ripple has emerged as a leading player in the realm of decentralized payment systems. Its protocol offers a secure and efficient means of transferring value across borders, making it an attractive option for banks and financial institutions looking to modernize their payment processes.

The case study of Fidor Bank exemplifies the benefits of adopting Ripple’s technology. By integrating the Ripple protocol into its internal settlement processes, Fidor Bank has improved efficiency and reduced reliance on traditional clearing mechanisms.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

The potential for Ripple’s protocol to expand to other banks is significant. If widely adopted, it could revolutionize the way financial institutions handle cross-border transactions. The case study of CIC’s micro-insurance products, which accept payments through M-Pesa, also illustrates how alternative rails can expand financial services to the underbanked.

By leveraging mobile technology and decentralized payment systems, traditional institutions can reach new customer segments and drive economic growth.

Ripple’s Role in the New Financial System

The best example of this phenomenon is Ripple’s recent partnership with Apple to develop Apple’s Tap-to-Pay system for iOS users. In Apple’s attempt to provide its users with seamless payment services, it looked to Ripple, a company with a proven track record in instant cross-border and general payment services. Partnerships like this could boost XRP’s adoption as Ripple’s technology gains adoption, potentially increasing XRP’s price in the long term.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News