Following the release of a new USTC re-peg proposal that doesn’t involve the minting of new LUNC tokens by a popular blockchain engineer and developer in the LUNC community, the embattled TerraClassicUSD token experienced a significant surge in price on October 10.

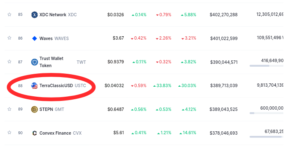

In the last 24 hours, TerraClassicUSD (USTC) has grown over 33% as the new re-peg proposal emerged and more than 30% in the last 7 days. At the time of writing, TerraClassicUSD (USTC) gained momentum on Monday and is currently trading for $0.04.

USTC was initially designed to serve as an algorithmic stablecoin with a fixed value of $1. But because of some design and management failures, USTC formerly denoted as UST lost parity with $1 plummeting to as low as $0.006218 price level in June. Since June to date, USTC has grown over 550%, according to data retrieved by Timestabloid on Coinmarketcap.

Read Also: Upcoming Terra Classic (LUNC) Upgrade Will Make the Network Become Fully Interoperable: Details

TerraClassicUSD (USTC) Re-peg Proposal

Earlier this month, Alex Forshaw, Edward Kim, and Maximilian Bryan jointly published the first TerraClassicUSD (USTC) re-peg proposal. However, this proposal faced a lot of criticism from the teeming Terra Classic community as it presented the idea of minting around 500 billion new LUNC tokens into the already hyperinflated token supply.

Among those who openly opposed Alex Forshaw and co re-peg proposal was Tobias Anderssen, a blockchain engineer and senior developer at Bitcoin Suisse AG. He wrote, “I am not holding the code hostage, I am simply saying I will not be part of building a feature that will create additional LUNC. If you can find other people to do it, then by all means, but those people have yet to arrive and till they do, you’re stuck with the devs that you have.” Tobias then hinted that he will put forward a proposal for the same purpose.

On October 9, Tobias Anderssen submitted his USTC re-peg proposal which had 4 key approaches including – the partial swaps concept, partitioned pools concept, remittance corridor, and Tranche concept. He mentioned that to attract the long-term capital investment needed to “re-peg” USTC, the community needs to establish an anti-fragile market-maker system that will incentivize new businesses to leverage the existing platform infrastructure in a way that is conducive to positive network growth while being prohibitive of economic instability.

Read Also: Terra Classic Sees a New Way to Massively Burn LUNC via 95,342 CEOs. Here’s How It works

It is worth noting that Anderssen is not completely ruling out the initial re-peg proposal from Alex Forshaw. He wrote, “even though we never really gained consensus on the matter of printing more LUNC, I feel that it would be pointless to go into further detail on the subject and believe his idea can be combined seamlessly with the other features to provide a construction that is stronger and greater than the sum of its parts.”

In addition, Tobias Anderssen noted while the idea of printing new LUNC tokens can create a short-term growth cycle for USTC that it is not a sustainable solution to the long-term growth of TerraClassicUSD because of the excess supply of LUNC, which is what gave rise to the 1.2% LUNC tax burn initiative.

Follow us on Twitter, Facebook, Telegram, and Google News