Stellar (XLM) is trading at $0.2882, experiencing a marginal dip of 0.0203% in the last session. The cryptocurrency recorded an intraday high of $0.3022 and a low of $0.2880, signaling a phase of consolidation. A deeper look into its price action across different timeframes highlights key support and resistance levels that could determine its next movement.

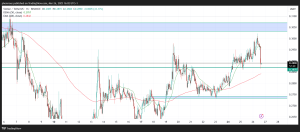

XLM Price Action on the 4-Hour Chart

The 4-hour timeframe shows XLM moving within a descending channel since late 2024. Recently, it has been holding support at $0.32, a crucial level preventing further downward pressure. The immediate resistance stands at $0.37, which aligns with the upper boundary of the channel. A break above $0.37 could indicate the beginning of a bullish trend, with potential targets set around $0.40–$0.42. Conversely, if XLM fails to gain upward momentum, sellers may push the price lower.

Short-Term Outlook: 1-Hour Chart Analysis

On the 1-hour timeframe, XLM is maintaining support at $0.274, coinciding with the 200-period Simple Moving Average (SMA). This level plays a vital role in determining the coin’s short-term direction. If XLM holds steady above $0.274, it could attempt a recovery toward $0.29–$0.305, where the 50-period SMA serves as resistance. A successful breakout past $0.305 could ignite bullish momentum, targeting $0.33–$0.35. However, failure to defend $0.274 could open the doors for a drop toward $0.26 or even $0.226.

Immediate Trading Range: 15-Minute Chart Analysis

For intraday traders, XLM is oscillating between support at $0.273 and resistance at $0.283 on the 15-minute chart. A break above $0.283 could drive the price toward $0.29, whereas a loss of $0.273 support could lead to a test of $0.267. Short-term traders should watch for volume surges to confirm breakouts.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

XLM Price Prediction: What’s Next?

XLM’s next move hinges on its ability to sustain above $0.274. A bullish breakout beyond $0.305 would set the stage for a rally toward $0.37, potentially breaking the descending channel on the 4-hour chart. However, if bearish pressure intensifies and $0.274 support is lost, we may see a decline toward $0.26 or $0.226, where buyers could step in for another recovery attempt.

Traders should closely monitor volume and market sentiment, as these factors will influence XLM’s short-term price trajectory.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on X, Facebook, Telegram, and Google News