Ripple, the major distributor of XRP, is making waves by selling off a substantial portion of its unlocked XRP reserves as the year ends. This move has stirred up discussions within the XRP community, raising questions about Ripple’s long-term commitment to the token and its potential impact on the cryptocurrency’s supply and price.

Unlocking the Vault: Ripple’s Powerful Grip

As the largest holder of XRP, Ripple’s influence over the token is undeniable. While most of its XRP stash remains locked in escrows until 2027, a billion tokens become available each month, giving Ripple significant control over the market. In December, the company retained 200 million XRP, which is 20% of the total XRP unlocked on December 1.

Read Also: Ripple CTO’s Cryptic Tweet Sparks Speculation Among XRP Army. Sell or Hold XRP?

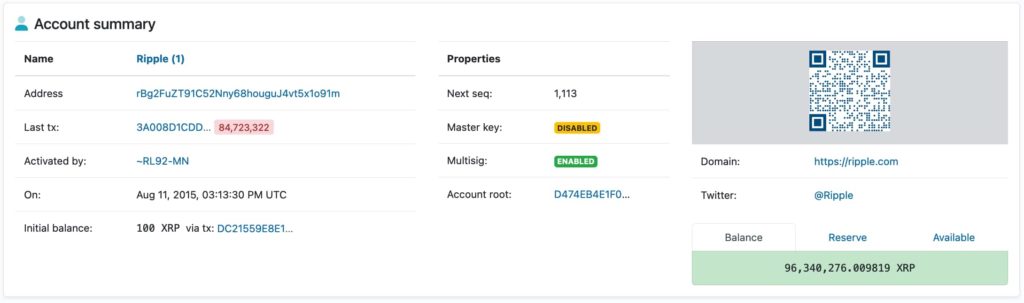

Ripple’s reserve stash resides in a designated wallet known as “Ripple (1)” on XRP Scan. This is where the company determines the fate of its monthly allocation – whether to keep it or, as seen in December, unload it onto the market.

Typically, Ripple deposits the desired portion back into this address before transferring the remaining to an anonymous account. From there, the tokens are dispersed across a network of unlabeled addresses, presumably under Ripple’s control, before they are moved to centralized exchanges.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Spending Spree: Ripple’s December Activity

Historically, Ripple’s monthly activity with its unlocked XRP has varied. Sometimes utilizes the entire allotment or holds a portion of it. December has been different.

Ripple has already sold a staggering 240 million XRP this month, even more than the 200 million unlocked. This indicates a deliberate effort to clear out a portion of its accumulated reserves before the year’s end.

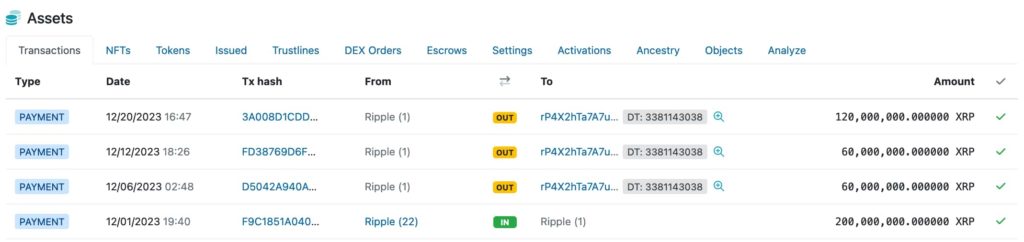

Ripple’s selling spree has not gone unnoticed. The XRP exodus occurred in three distinct bursts: an initial 60 million XRP on December 6th, followed by another 60 million 6 days later, and finally, a substantial transaction of 120 million XRP on December 20th, all directed to the same mysterious destination.

Read Also: XRP’s Victory Takes Ripple to the Flight of Disrupting Banking System

What Remains in the Vault: A Potential Market Flood

Interestingly, Ripple’s reserve account still holds a significant 96.34 million XRP, which could still be sold before the year ends. At the current price of $0.62, this amounts to nearly $58 million.

These transactions directly contribute to the inflation of XRP’s supply as the newly unlocked tokens enter the circulating pool each month. This grants Ripple undeniable power to influence the token’s economic dynamics and price trajectory.

Follow us on Twitter, Facebook, Telegram, and Google News