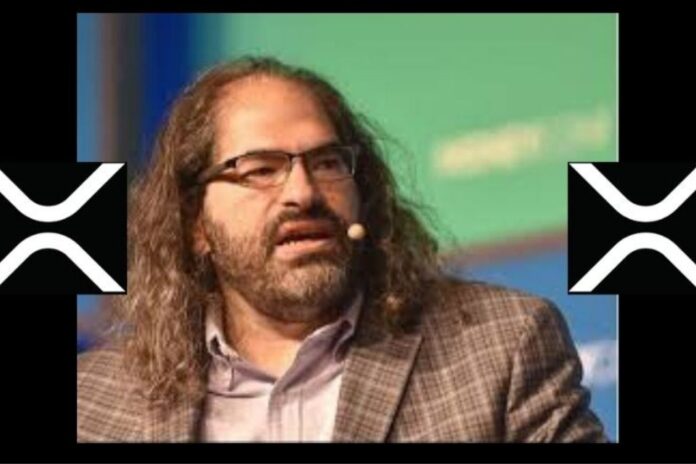

In a recent discussion on X, Ripple’s Chief Technology Officer, David Schwartz, addressed concerns about the Automated Market Maker (AMM) potentially causing a drop in XRP’s value due to increased selling pressure.

FrancisBovineSwift (@SwiftBovine) asked an interesting question in reply to David Schwartz’s post about the XLS-30 AMM amendment being open for voting. FrancisBovineSwift asked if the launch of the AMM might increase selling pressure when users begin to pool their assets.

Read Also: Ripple CTO David Schwartz Discloses Big Deal Hampered By The SEC Lawsuit

Schwartz acknowledged this possibility in his reply, noting that if the AMM draws mainly from XRP holders, it might initially lead to selling pressure. However, he suggested that this selling pressure could be outweighed by buyers going in the opposite direction. This could create a balance and result in increased buying pressure.

It's true that if the AMM draws mainly from XRP holders, it will be a short-term net increase in selling pressure. I doubt that will be significant and might be even be outweighed by people going in the other direction.

— David "JoelKatz" Schwartz (@JoelKatz) September 12, 2023

Schwartz’s statement drew attention, implying anticipation of a surge in XRP buyers once the AMM is live. This could have potential benefits for XRP.

An influencer in the XRP community replied to Schwartz’s post, describing his words as a “hot take” and highlighting his expectations of substantial buying pressure when the AMM launches.

Schwartz’s enthusiasm for the XRPL AMM is evident. He once stated that it’s the feature he had been anticipating and he’s more excited for it than any other proposed XRPL feature.

More Community Reactions

XRPcryptowolf (@XRPcryptowolf) replied, asking why the feature is Schwartz’s favorite feature. Schwartz explained that there were multiple reasons but the automated trading strategies by AMMs to leverage market volatility are the main reason behind his excitement. He said he found it fascinating.

Saul (@uptownsaul) asked about harvesting volatility, wondering whether it was aimed solely at profit or if it could stabilize swings in price and limit volatility.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Read Also: Ripple CTO David Schwartz Amazes XRP Community With Recent Tweet: “XRP Fixes This”

Schwartz replied, pointing out that in theory, the AMM would reduce volatility by selling XRP strategically during price increases and buying during decreases. He highlighted that it could turn the market volatility to yield and stabilize the price over time.

Another user, Wen Moon (@WenMoonTok), asked if the AMM would limit a surge for XRP by increasing sales pressure, similar to the original question asked by FrancisBovineSwift.

In response, KeanuSkeeves (@KeanuSkeeves589) reiterated Schwartz’s explanation of the AMM, saying, “No. Once you put XRP into an AMM pool, your XRP will only be sold when the price of XRP goes up. If the price of XRP goes down then you are actually buying more XRP.”

If the AMM can bring selling pressure like Schwartz suggests, it might create substantial buying interest, which would in turn drive up the price of XRP.

Follow us on Twitter, Facebook, Telegram, and Google News