In the dynamic world of cryptocurrencies, where speculation and hype often take center stage, XRP has become a focal point of discussion.

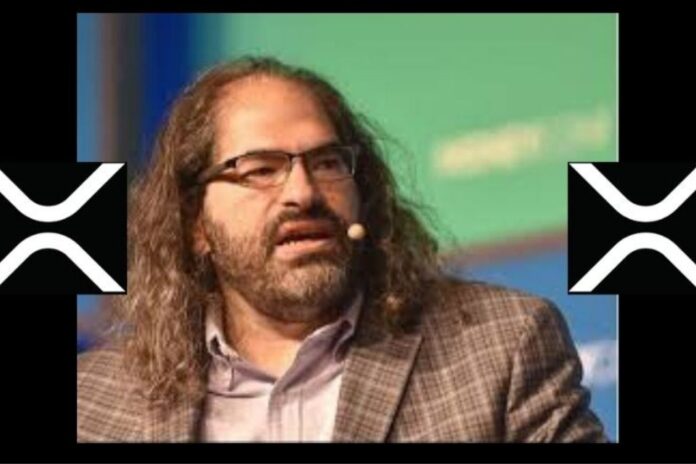

Recently, Ripple’s Chief Technology Officer, David Schwartz, took to X to pour cold water on the idea of burning the massive XRP escrow. Is this a wise financial decision or just another illusion in the vast desert of digital assets?

Read Also: Ripple CTO David Schwartz Reveals Five Exciting Predictions for 2024

Echoes of a Burning Wish

The flames of this debate were ignited by a pseudonymous XRP community member known on X as “GPDBurnTheEscrow,” who questioned Ripple’s management of its XRP holdings, particularly the monthly releases from the escrow account. Concerns arose about market pressure and the company’s commitment to reducing the token supply.

Schwartz, in his characteristic clear and concise manner, outlined Ripple’s limited options: either holding or actively reducing their XRP stash. Burning, while appearing dramatic, was not considered a viable solution. He raised doubts about its feasibility and, more importantly, its potential benefits.

I can't think of any set of events that would lead that to happen that's even remotely probable. I also don't think it would have any real benefits.

— David "JoelKatz" Schwartz (@JoelKatz) January 8, 2024

Stellar Saga: A Cautionary Tale of Burnt Offerings?

To reinforce his point, Schwartz drew a curious parallel with Stellar, the brainchild of Ripple co-founder Jed McCaleb. In 2019, Stellar faced similar concerns about its inflated token supply, leading to a grand incineration ceremony that reduced the total pool by 55 billion tokens.

However, the anticipated surge in token price turned out to be short-lived, leaving XLM to fizzle out with a disappointing thud. Schwartz argued that this shattered the myth of burns to boost prices, serving as a reality check for XRP enthusiasts who clamor for the incineration of 40 billion XRP in Ripple’s escrow wallet.

Beyond Binary Solutions: Demystifying Tokenomics

Acknowledging community anxieties, Schwartz encouraged the audience to engage in critical thinking and delve deeper into XRP’s tokenomics. He refrained from making elaborate predictions, recognizing potential inaccuracies and legal obstacles. His message was clear: the power to understand lies within the community itself.

While “GPDBurnTheEscrow” appreciated Schwartz’s engagement, a hint of pessimism still lingered. However, the CTO countered by emphasizing two key principles. Firstly, market expectations are often already factored into asset prices, making radical changes without clear benefits prone to negative reactions.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Read Also: Ripple CTO’s Cryptic Tweet Sparks Speculation Among XRP Army. Sell or Hold XRP?

Secondly, Schwartz highlighted the importance of understanding the interplay between supply, demand, and utility in XRP’s tokenomics. Burning might seem to reduce supply, but its true impact depends on how the remaining tokens are utilized and how effectively Ripple fosters demand within its ecosystem.

To some, Schwartz’s emphasis on rational pricing and market skepticism might appear pessimistic. However, it reflects a crucial dose of reality in a market driven by hype and speculation. Ripple’s acknowledgment of potential downsides and advocacy for a balanced approach demonstrates its commitment to long-term sustainability over short-term gains.

The XRP escrow debate serves as a microcosm of the larger conversation surrounding Ripple’s future. It’s not merely about burning or holding; it’s about finding the optimal strategy to unlock the full potential of XRP and its underlying technology.

Follow us on Twitter, Facebook, Telegram, and Google News