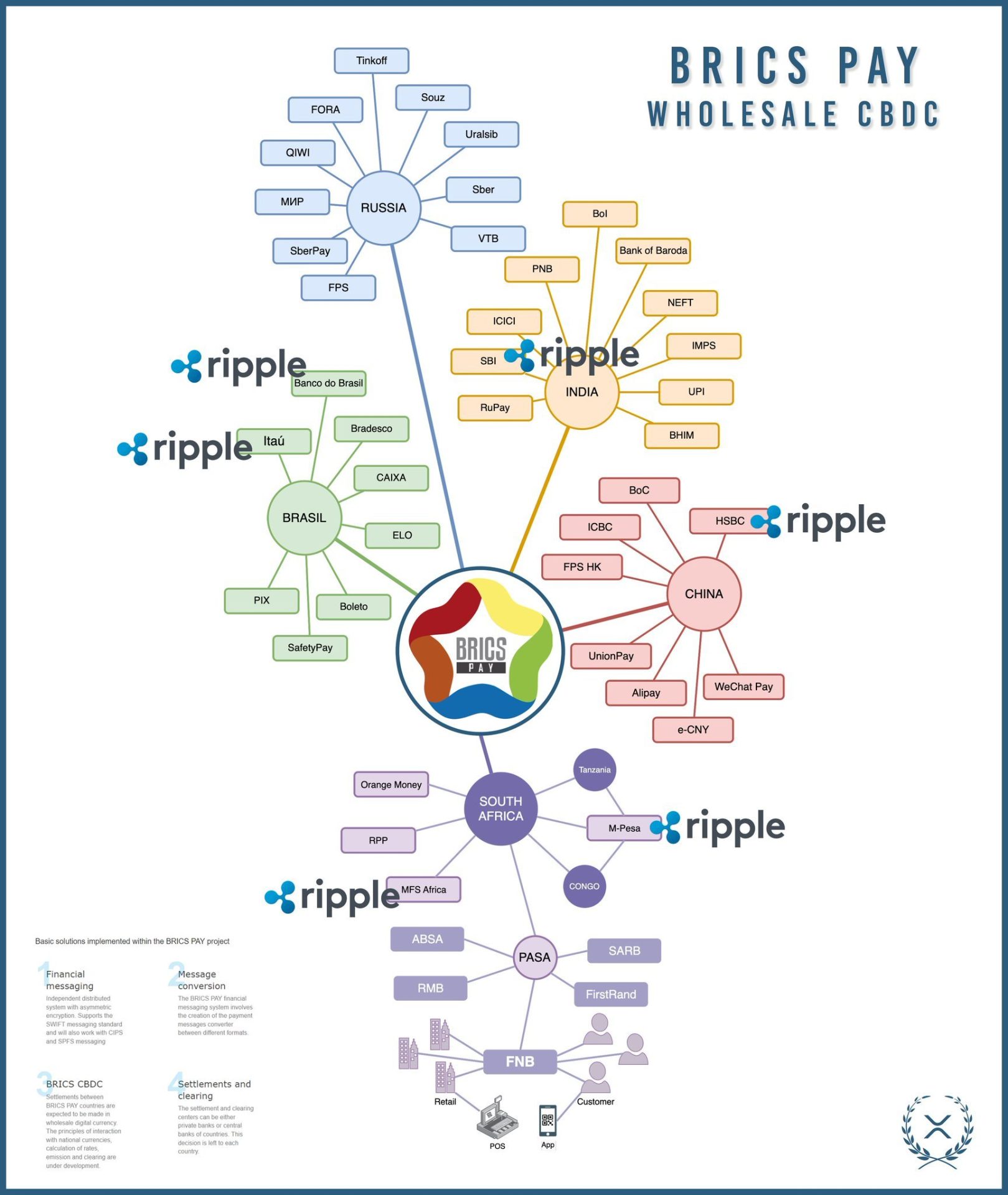

The blockchain technology company Ripple has emerged as a potential player in the development of BRICS Pay, a digital payments platform created by the member countries of BRICS (Brazil, Russia, India, China, and South Africa).

This news, shared by Good Morning Crypto (@AbsGMCrypto) on X, has sparked interest in the potential role of Ripple’s technology and its native token, XRP, within the BRICS Pay ecosystem.

Read Also: Putin Confirms BRICS Payment System with XRP Considered As Bridge Currency

A New Landscape for Digital Transactions

BRICS Pay aims to revolutionize digital payments within the BRICS bloc, facilitating transactions between the member countries’ vast populations. With an estimated combined population exceeding 3 billion, BRICS Pay has the potential to connect a significant portion of the global unbanked population and streamline cross-border financial interactions.

Ripple’s core strength lies in its global network of financial institutions, including several with established presences within the BRICS nations. Good Morning Crypto highlighted Ripple’s partnership with SBI Holdings, a major Japanese financial services group that employs Ripple’s technology for remittances in multiple countries.

The list also included HSBC, a multinational banking and financial services company with a strong presence in BRICS countries, ONAFRIQ (MFS Africa), a leading mobile money transfer service provider across Africa, and Banco do Brasil, the second largest bank in Brazil.

These existing connections position Ripple strategically for potential involvement in BRICS Pay. Ripple’s technology and XRP as a bridge currency could offer advantages for BRICS Pay, including:

Faster Settlement Times: XRP facilitates real-time settlements between financial institutions, significantly reducing the time it takes for cross-border transactions to be completed.

Reduced Transaction Costs: Ripple’s network eliminates the need for intermediary banks, leading to lower transaction fees for businesses and individuals. Michael Arrington of Arrington Capital recently shared a transaction his company performed, where it transferred $50 million worth of XRP in 2 seconds with only 30 cents in fees.

Enhanced Transparency: Blockchain technology provides a secure and transparent record of transactions, improving traceability and reducing the risk of fraud.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Read Also: Analyst: BRICS and Tokenization Market Could Send XRP to $10,000

Is XRP the Next Big Bridge Currency?

It is important to note that Ripple’s official involvement in BRICS Pay remains unconfirmed. While the connections between Ripple and BRICS member countries’ financial institutions are promising, official announcements from either Ripple or the BRICS nations are needed to solidify any potential partnership.

If Ripple does become integrated into BRICS Pay, it would represent a significant milestone for the company. Widespread adoption within the BRICS bloc could significantly increase the utility and value of XRP, potentially solidifying its position as a leading bridge currency for cross-border transactions and causing a significant price increase.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News