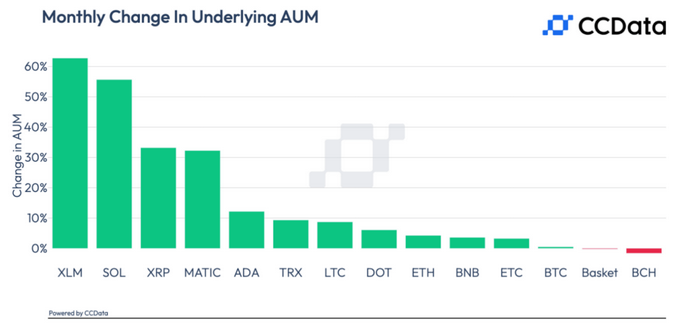

Crypto investment products focused on XRP, Stellar Lumens (XLM), and Solana (SOL) saw major inflows this July, resulting in a massive increase in their assets under management (AUM) over the same period.

According to the Digital Asset Management Review report recently released by CCData, the performance of the altcoins helped the total assets under management of these products to see a miner increase of 1.14% to $33.7 billion. The data also reveal that AUM for these products has risen 71.5% so far this year.

Read Also: InvestAnswers Shows How BlackRock-Coinbase Partnership Could Send Bitcoin (BTC) To $773,000

Through the help of Grayscale’s XLM product that logged a premium exceeding 330%, products focusing on Stellar (XLM) experienced an increase of 62.7% to reach $17.3 million in AUM.

Likewise, the recent ruling by Judge Analisa Torres in favor of Ripple and XRP has helped products focusing on both XRP and SOL experience remarkable growth.

XRP products experienced a 33.2% rise, growing its AUM to $65.7 million, while SOL products rose by 55.7% to reach $87.8 million in AUM.

Read Also: Google Set To Accept Crypto Payments For Cloud Services Via Coinbase Commerce Service

Further, into the report, the United States continues to dominate in terms of crypto investment products’ assets under management (AUM). The recent Bitcoin exchange-traded fund (ETF) filings by financial giants such as BlackRock and Fidelity have certainly been aiding the growth of these products in the United States.

According to the report, the surge in interest helped reduce concerns related to the regulatory scrutiny of crypto, which has been a major issue impacting the market. The report added that the United States now holds a whopping $26.3 billion in AUM and a market share of 78%.

Follow us on Twitter, Facebook, Telegram, and Google News