Raoul Pal, founder of Real Vision and Global Macro Investor, has revealed that he spent lots of time and resources updating his numbers on global crypto adoption.

Pal’s new numbers are based on data from Crypto.com, the World Bank, and Global Macro Investor. He believes that crypto-assets are growing at a pace than the internet.

The macroeconomic expert stated that if the growth of the crypto economy slows to the same pace as the internet, the crypto industry would have relatively 5 billion users by 2030.

In a series of tweets, Raoul Pal noted:

“2021 was an accelerating growth year and the Reed’s Law effect of networks built upon networks creating even more exponentiality is clear. But year six after the first five million users, crypto has 295 million participants and the internet had 119 million.

Crypto is growing at 137% a year while the internet grew at 76%. As I always say, this is the fastest adoption of technology the world has ever seen.”

“Using the 76% growth rate (suggesting a near halving of network growth as network matures), we now get to 5 billion users by 2030.

I.E. it becomes THE dominant source of owning, transferring and recording value and contractual terms global. Wow!”

Valuation Model For Bitcoin, Ethereum, XRP, and Polkadot

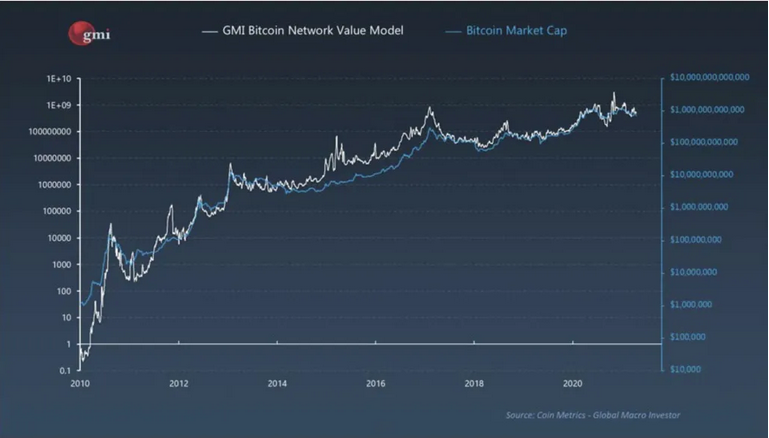

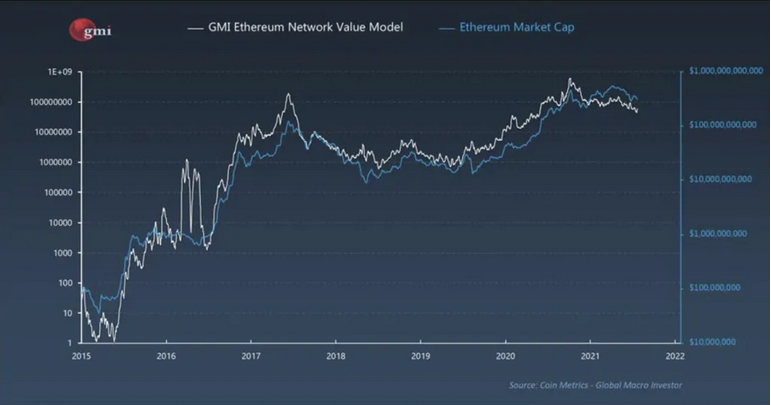

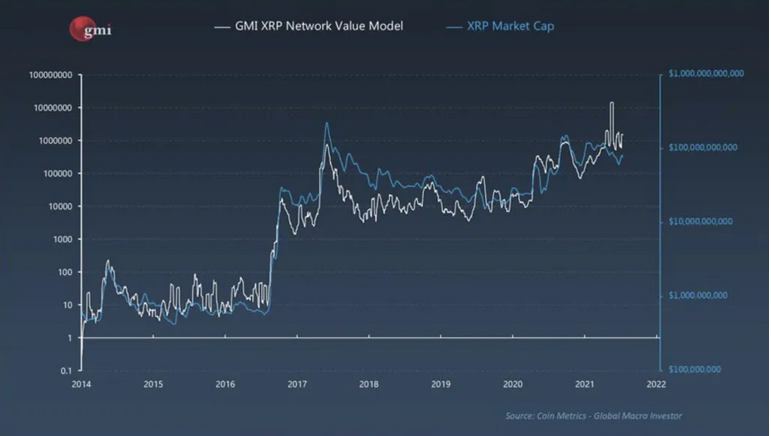

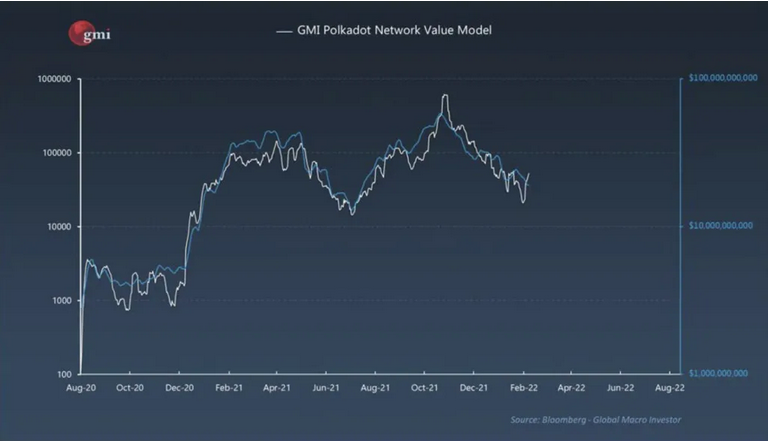

According to Pal, he has designed a sure way to determine the value of a given crypto network by multiplying the number of daily transaction volumes in dollars, by the number of active users.

He pointed out that his equation remarkably tracks the market capitalization of Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Polkadot (DOT).

He added that Ethereum may eventually flip Bitcoin in terms of market capitalization if its decentralized application (DApp) sector gains notable adoption.

“Each chain creates value for different reasons – BTC for pristine collateral, security and store of value brings large numbers of users transferring large sums of value. Hence why it is the most valuable network.

But ETH has more applications and the transaction value per monthly user is broadly in line with BTC. Thus, if ETH attracts more users over time, it will flippen BTC in market cap (not that it matters as we are comparing apples with oranges! Both have different value/uses).”

Raoul Pal: Bitcoin (BTC) Could Reach $600,000

Raoul Pal also considered rates of adoption going forward to predict the future price of Bitcoin (BTC)

“Assuming BTC remains one standard deviation below trend it gives a price target of $600,000. If it slows to two standard deviations below trend, then you get a number of around $300,000.

Maybe the regression trend should be taken from 2013 to avoid the very early spike. That gives slower growth and lower targets. That gives trend at $700,000, one standard deviation [above] at $350,000 and two standard deviations at $200,000.”

Follow us on Twitter, Facebook, Telegram, and Google News