Solana blockchain continues to prove its worth in the crypto industry, especially in the non-fungible token (NFT) sector, challenging Ethereum, the largest smart contracts platform.

According to the NFT sales tracker CryptoSlam, the sales volume of its non-fungible token (NFT) surpassed $1 billion in January 2022.

Read Also: Legendary Boxer Mike Tyson Wonders How High Solana (SOL) Price Can Rise

Solana (SOL) Gaining Traction in the NFT Sector

In the later part of 2021, Solana’s NFTs gained popularity due to the problem of high transaction fees on the Ethereum network, the most popular blockchain for non-fungible tokens.

The first Solana NFT to break $1 million occurred on 11th September 2021, for a Degenerate Ape Academy NFT, part of a collection of 10,000 algorithmically generated 3D primates. While the most expensive Solana NFT sold for $2.1 million about a month later.

Read Also: Wife of Former U.S. President Donald Trump Is Launching A NFT Platform on Solana Blockchain

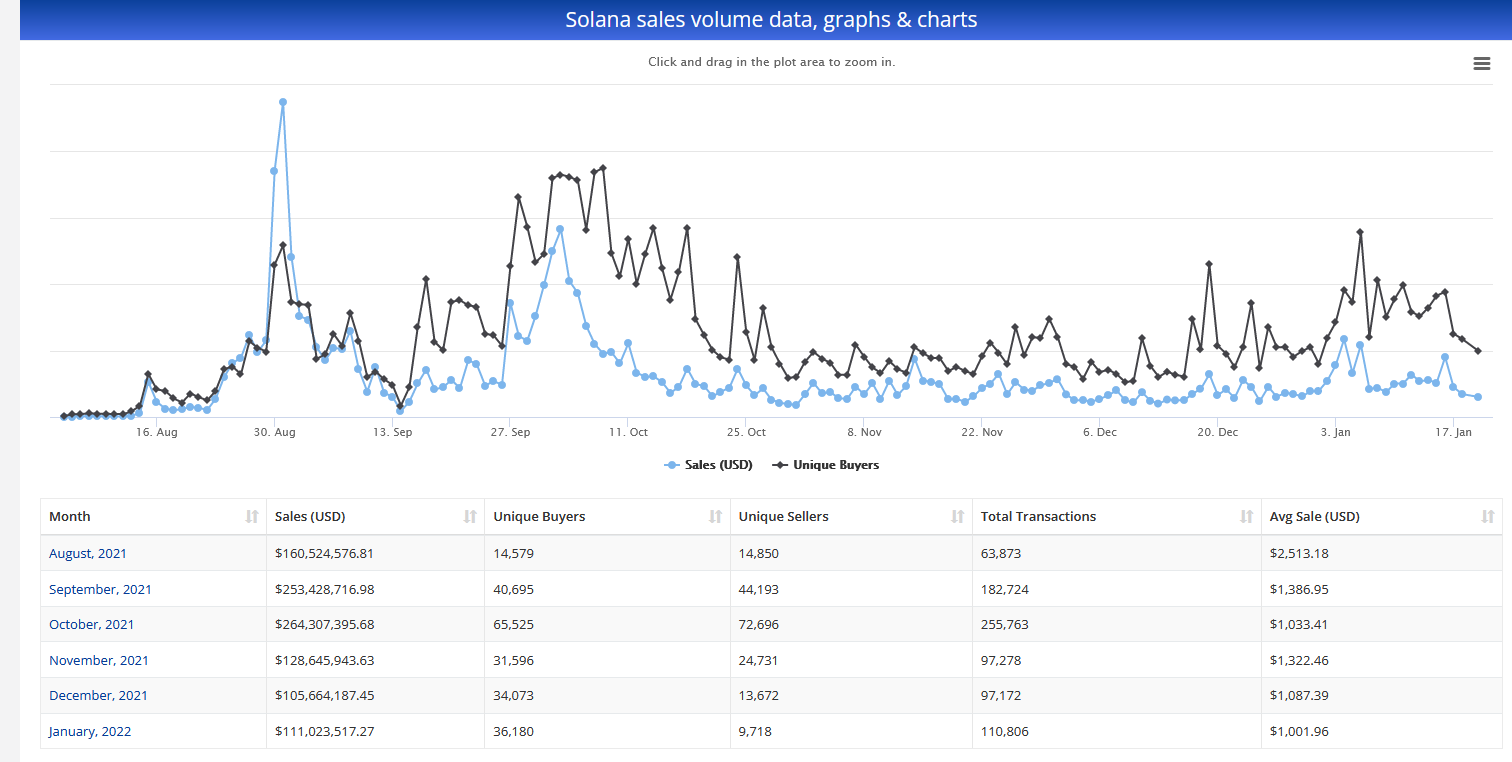

According to the data shared by The Block, Solana’s highest weekly trade volumes reached $160.39 million on 29th August 2021. Howbeit, Solana is still nothing compared to Ethereum in terms of NFT trading volumes.

Also, Solana lacks high-profile NFT projects that can compete with Ethereum-based NFTs such as Bored ape Yacht Club and CryptoPunks. Nevertheless, healthy investment in the Solana NFT space has continued to gain traction and 2022 is another year to prove its worth in the NFT sector of the crypto ecosystem.

JPMorgan Thinks Ethereum is Losing Ground to Solana in the NFT sector

Due to the significantly high transaction fees on the Ethereum network, JPMorgan’s analysts, led by Nikolaos Panigirtzoglou, believe that the largest blockchain in the NFT market is already losing ground to rivals such as Solana in the NFT sector of the crypto industry.

Read Also: Solana Partners with Opera to Make the Browser’s Users have a Wallet with Full DApps Compatibility

In a recent note to clients, JPMorgan pointed out that Ethereum’s volume share of NFT trading has fallen from relatively 95% recorded at the start of 2021 to 80%.

Panigirtzoglou wrote:

“It looks like, similar to DeFi apps, congestion and high gas fees has been inducing NFT applications to use other blockchains…

“If the loss of its NFT share starts looking more sustained in 2022, that would become a bigger problem for ethereum’s valuation.”