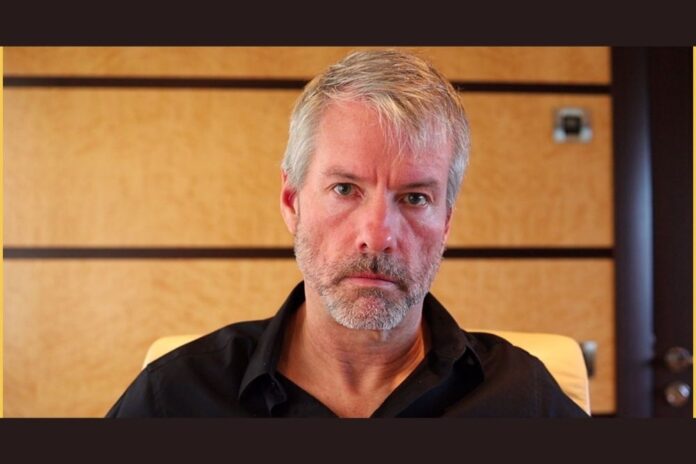

Michael Saylor, the founder and CEO of Microstrategy has recently debunked the rumor that says the company has been secretly selling its Bitcoin holdings.

In a tweet about three days ago, Saylor pointed out that as a publicly listed company, MicroStrategy cannot make sales of assets under its custody at will. He said the firm is obligated by the law to file any intended transaction with the United States Securities and Exchange Commission (SEC).

Read Also: MicroStrategy CEO to Elon Musk: If You Can’t Buy All of Twitter, You Can Buy a Fraction of Bitcoin

MicroStrategy CEO added that shareholders have to be informed of any Bitcoin (BTC) sale. And it should be noted that Saylor has been reiterating the fact that the company is not ready to sell its Bitcoin holdings but to keep accumulating.

Michael Saylor tweeted, “Not sure who needs to know this, but when $MSTR makes any material change to its corporate strategy (to acquire & #hodl bitcoin) or to its #bitcoin holdings, we disclose this to our shareholders via SEC filings, available to all.”

Not sure who needs to know this, but when $MSTR makes any material change to its corporate strategy (to acquire & #hodl bitcoin) or to its #bitcoin holdings, we disclose this to our shareholders via @SECGov filings, available to all.

— Michael Saylor⚡️ (@saylor) April 22, 2022

Rumors regarding the sales of Bitcoin by MicroStrategy surfaced after an address identified as “1P5ZED” was involved in moving a huge amount of BTC.

Following the mammoth transaction, a number of crypto analysts and enthusiasts insinuated that the Bitcoin whale was MicroStrategy or a crypto exchange.

MicroStrategy Purchased 4,167 BTC

Michael Saylor is now regarded as a top Bitcoin proponent in the crypto industry. His firm has been leading institutional investment in Bitcoin (BTC) and plans to keep buying despite the unfavorable trend of crypto prices.

In early April, Microstrategy announced the acquisition of 4,167 BTC worth relatively $190.5 million at the time of purchase. The company initiated the acquisition a few days after announcing that it was obtaining a bitcoin-collateralized loan to purchase more Bitcoin (BTC).

The report disclosed that the firm now holds a total of 129,218 BTC acquired at an average price of $30,700 per Bitcoin.

Follow us on Twitter, Facebook, Telegram, and Google News