Over the last couple of years, several mainstream financial entities, such as banks, hedge funds, and others, have entered the crypto bandwagon via Bitcoin (BTC), while 2021 has seen an increasing number of these companies exploring the realm of digital assets using Polkadot (DOT).

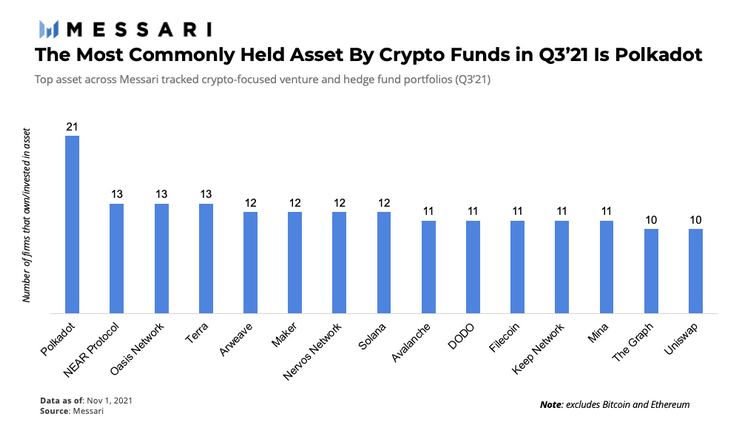

In this regard, a report by blockchain analytics firm Messari revealed that 21 of the world’s 53 most prominent fund managers actively invested in Polkadot (DOT) last year, making it one of the most sought-after assets, followed by other DeFi/alt tokens such as Near Protocol (NEAR), Terra (LUNA).

Read Also: Polkadot Parachains Finally Launches. What Does This Mean to Ethereum’s Economic Slavery?

One of the core reasons behind Polkadot’s growing dominance is the fact that the platform lays a high degree of importance on cross-chain interoperability, an aspect of crypto-tech that most experts believe will continue to define the future of the crypto ecosystem.

In terms of Polkadot’s native operational design, the project makes use of a unique concept referred to as Parachains, which allows it to support multiple layer-1 blockchains running in conjunction with its central chain.

The setup is able to mitigate many of the transactional congestions being faced by prominent projects such as Ethereum, whose gas fee rates have continued to remain quite steep at around $40 on average despite the platform undergoing a number of upgrades over the past year, especially Ethereum Improvement Proposal (EIP) 1559 that was implement along with London hard fork back in August 2021.

Not only that, with the delay in the implementation of Ethereum 2.0, the ecosystem is only able to process around 30 transactions per second (TPS) in its current iteration, which is substantially lower than Polkadot’s current running capacity of 170 TPS.

In a recent statement on X, crypto enthusiast All Things XRP drew a parallel between…

XRP has officially overtaken Ethereum as the most actively traded altcoin in Japan, according to…

Ripple’s recent $1.25 billion acquisition of Hidden Road, a multi-asset prime brokerage company, marks a…

A recent official publication by global payments giant Mastercard has turned heads in the cryptocurrency…

In a bold and cryptic move that has sparked intense speculation within the cryptocurrency community,…

Crypto analyst CasiTrades has shared an important update regarding XRP’s recent price movement, emphasizing technical…