Digital assets manager CoinShares has revealed that institutional investors are largely dumping their Ethereum positions in favor of one of its biggest competitors, Solana (SOL), amid the current market downturn.

In the latest Digital Asset Fund Flows Weekly report, CoinShares revealed that Ethereum investment products have suffered over 10 weeks of successive outflows at a time when The Merge is closer than ever.

We Are On Twitter: Follow Us

According to the report, as Ethereum (ETH) continues its weekly loss, Solana (SOL) seems to be benefitting.

The report read in part:

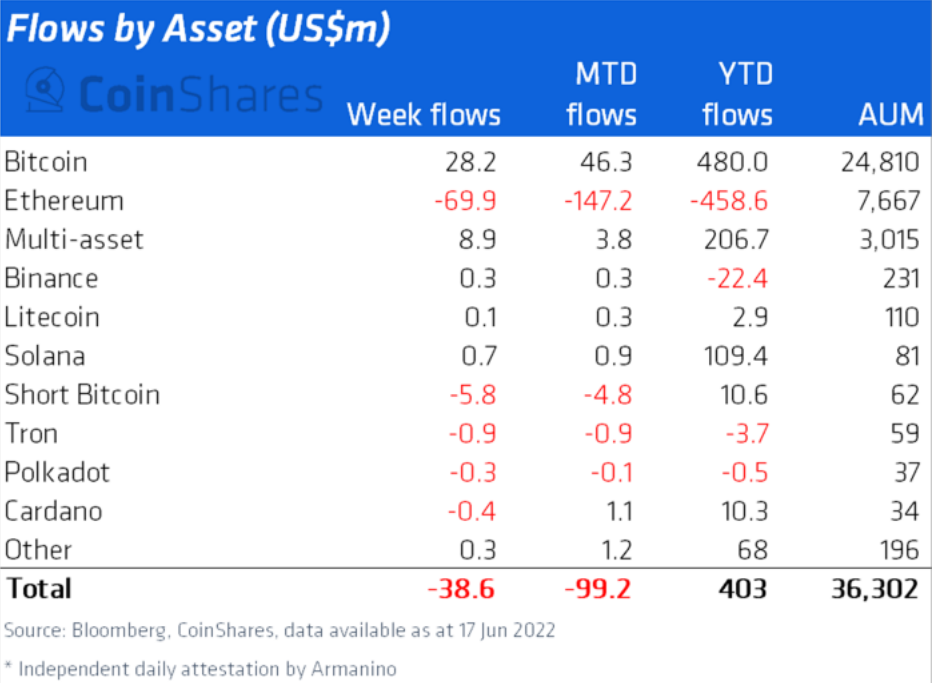

“Ethereum continues to suffer with outflows totaling $70 million last week having suffered 11 straight weeks of outflows, bringing year-to-date outflows to $459 million. Solana looks to be benefitting from investors’ worries over The Merge (ETH2), with inflows of $0.7 million last week and $109 million year-to-date.”

Read Also: Here’s Why Coin Bureau Host Remains Confident in Solana (SOL) Regardless of Recent Outages

On the other hand, CoinShares’ report says that the Institutional Investment products of Bitcoin (BTC), the largest cryptocurrency by market cap, saw inflows totaling $28 million last week.

“Bitcoin saw inflows totaling $28 million last week and looks to be benefitting from weak prices with month-to-date inflows at $46 million.”

According to the firm, despite Bitcoin’s inflows, the overall digital asset investment product market still suffered about $40 million in outflows over the last week. Howbeit, the year-to-year flows remain positive at $403 million.

Other altcoin products that experienced outflows last week are Cardano (ADA), Polkadot (DOT), and Tron (TRX). But Binance Coin (BNB) and Litecoin (LTC) investment products enjoyed inflows.

Follow us on Twitter, Facebook, Telegram, and Google News