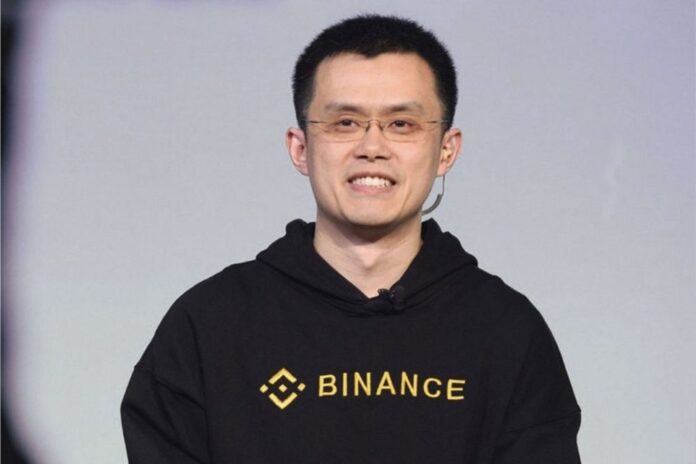

Changpeng Zhao (CZ), the CEO of Binance, the world’s largest crypto exchange by trading volume, has recently stated that the crypto market is likely to see more consolidation as Bitcoin (BTC) continues to change hands around the $20,000 price region.

In a recent interview with Bloomberg, CZ reveals that the exchange could spend more than $1 billion on investment deals within the next three months, irrespective of the current market downturn.

Read Also: CZ Binance States One Catalyst to Boost Global Adoption of Crypto

When asked about his interest in acquiring crypto lenders, he replied, “We did look at a lot of lenders in recent months, because that’s where all the issues are… Many of them, they just take a user’s money and give it to somebody else. There’s not a lot of intrinsic value. In that case, what’s to acquire? We want to see real products that people use.”

More Market Consolidation Likely

Speaking about the current market trend, CZ Binance said we are likely to see more market consolidation, concluding that there are a lot of risks, pain, and opportunity in the bear market.

CZ Binance noted:

“Overall at a high level, during the bear market we’ll see more market consolidation… There’s a lot of risks and a lot of pain, but also a lot of opportunity.”

Recall that on Thursday, hackers attempted to siphon about $560 million worth of BNB tokens from the BSC Token Hub, the cross-chain bridge of Binance.

Although the hackers were unable to drain all the funds, they managed to send over $100 million to other chains before BNB Chain was paused for maintenance.

Commenting on the speed of fixing the issue to prevent escalation, Binance CEO said:

“I was impressed by the quick actions the BNB Chain team took. I am not that involved in the technical side of BNB Chain. Far less than Vitalik with ETH. The principles of issue handling are simple & important: fast, transparent & responsible.”

Follow us on Twitter, Facebook, Telegram, and Google News