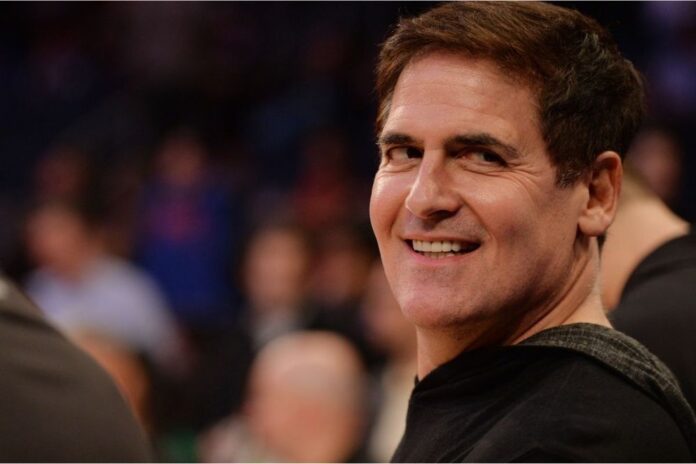

Mark Cuban, a billionaire entrepreneur and longstanding crypto proponent, has recently predicted the next big thing that will possibly initiate an implosion that could shake the crypto industry once again. Recall that the market is still struggling to recover from the collapse of Terra blockchain and FTX exchange

In a new interview with the Street, Cuban said he believes that the next implosion in the crypto ecosystem will originate from the discovery and removal of wash trades on centralized exchanges.

Read Also: Billionaire Mark Cuban States the Condition That Can Make Him Buy More Bitcoin (BTC)

Mark Cuban noted:

“I think the next possible implosion is the discovery and removal of wash trades on central exchanges. There are supposedly tens of millions of dollars in trades and liquidity for tokens that have very little utilization. I don’t see how they can be that liquid.”

What is Wash Trade? Wash trade is a form of market manipulation in which an investor concurrently sells and buys the same assets to create misleading. This is often practiced in the crypto market as a means to pump and dump a particular digital asset.

The Street also reported that Cuban said he does not have specifics to back his prediction.

According to a recent study conducted by the National Bureau for Economic Research (NBER), which involved 29 crypto exchanges, 70% of the volume on unregulated exchanges is wash trading.

Benford’s Law, a statistical benchmark for fraud detection, was used by these researchers to analyze trading data from these exchanges.

Read Also: Billionaire Mark Cuban Joins Ethereum Merge Backers, Says He’s Bullish on ETH

The Conclusion of the research read in part:

“We estimate the average wash trading to be 53.4% of trading on unregulated Tier-1

exchanges and 81.8% on Tier-2 exchanges and provide several robustness and validation

tests.

“We further provide suggestive evidence that wash trading inflates exchange rankings and cryptocurrency prices, in addition to being significantly predicted by market signals such as past cryptocurrency prices and volatility and exchange characteristics such as exchange age and userbase.

“As the first comprehensive study of the pervasive crypto wash trading, our paper not only provides a cautionary tale to regulators around the globe but also reminds the readers of the disciplining or screening effects of regulation in emerging industries, the importance of using wash-trading-adjusted volume in certain empirical studies, and the utility of statistical tools and behavioral benchmarks for forensic finance and fraud detection.”

Follow us on Twitter, Facebook, Telegram, and Google News