A popular crypto analyst and trader, who is the host of InvestAnswers, has shared three possible price targets for Bitcoin (BTC), the largest cryptocurrency by market capitalization, in the year 2030, as the flagship crypto strives to surge far beyond $30,000 support level.

In a new video shared with his teeming subscribers on YouTube, the analyst stated that the bear case for Bitcoin (BTC) in 2030 is $576,000, which is a relatively 1,880% increase from current prices.

Read Also: MicroStrategy CEO Michael Saylor: “I Will Be Buying Bitcoin (BTC) At the Top Forever”

The analyst noted:

“So not bad from where we are today. That’s basically a 20x give or take, a couple of dollars, which is a huge return, but still, it is a moving target. Things change all the time. Adoption changes, networks changes, competition changes. Bear that in mind.”

Second Price Target

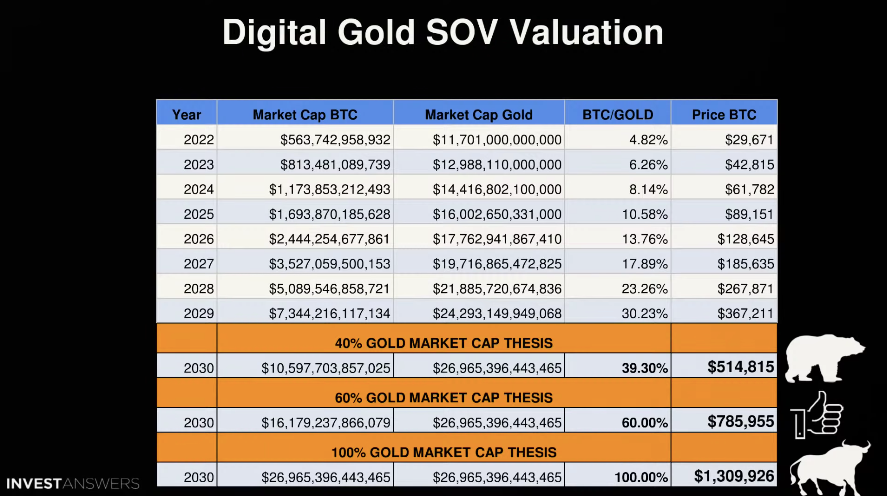

Looking at the market cap of Gold, the analyst said Bitcoin (BTC) could eventually grow to become 40%, 60%, or 100% of Gold’s market capitalization, which represents $514,815, $785,955, or $1,300,000, respectively, by 2030.

He said:

“The digital gold/store of value valuation narrative is very, very important. A lot of people, all the top experts in the place, do look at this as a core market valuation method… The adoption of Bitcoin is faster than that of the internet, and that of mobile phones right now. Therefore, due to Metcalfe’s Law, this is completely believable.”

Third Price Target

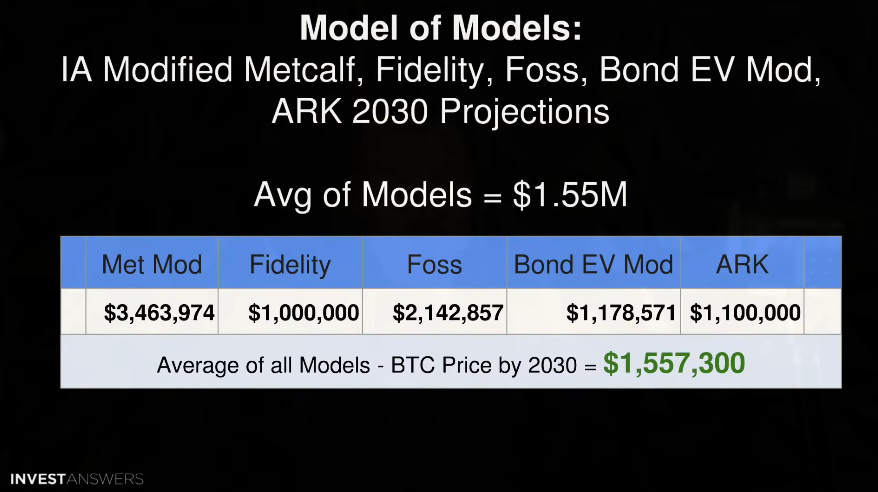

The analyst evaluated the third price target by finding the average of the collection of popular models from Fidelity, ARK Invest, and others.

After the combination of the popular models, the analyst comes up with an average price target of $1.55 million in the year 2030.

Follow us on Twitter, Facebook, Telegram, and Google News