A recent observation by tech researcher and observer SMQKE has ignited discussion about XRP viability in the cryptocurrency community.

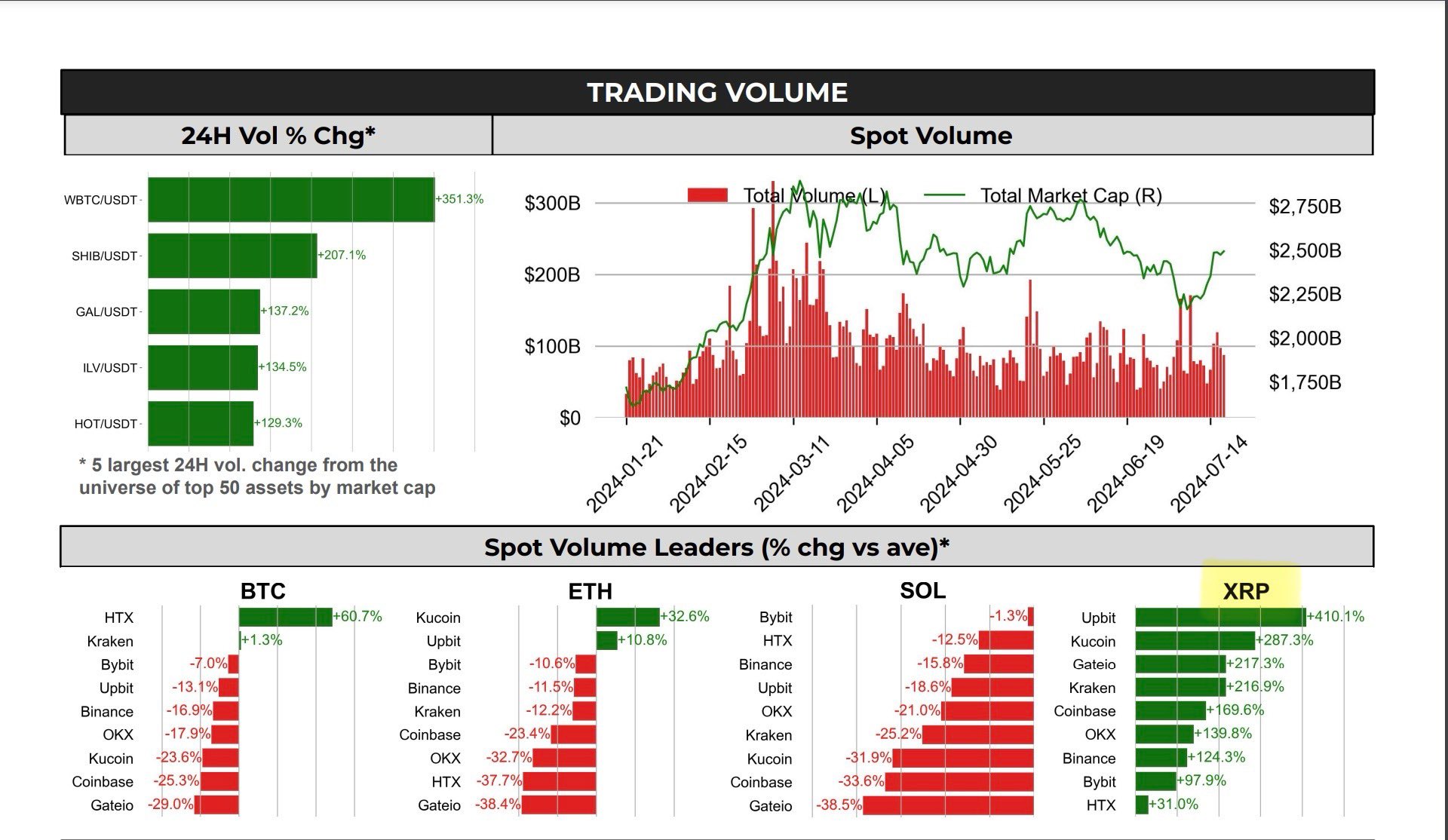

According to SMQKE, XRP spot trading volume has exhibited a significant surge, outpacing those of Bitcoin, Ethereum, and Solana on major cryptocurrency exchanges including Coinbase, Kraken, and Binance.

This unexpected development has prompted speculation about potential on-chain and behind-the-scenes activities influencing the market. The substantial increase in XRP trading volume has raised questions about the correlation between volume and price movement.

An X user, Caleb, posed a pertinent query, inquiring about the possibility of such a significant volume increase occurring without a corresponding price surge.

At the time of press, XRP is trading at $0.60, reflecting a 1.90% price decline over the past 24 hours. However, the token has demonstrated a more positive trajectory over the past week, with a 3.21% price increase. This price behavior, in conjunction with the unusual volume surge, underscores the intricate dynamics at play within the XRP market.

Potential Factors Influencing XRP’s Trading Volume

Several factors could contribute to the observed increase in XRP’s trading volume. A resurgence of investor interest in the token, driven by factors such as regulatory developments or technological advancements, could be a contributing factor.

Additionally, increased institutional adoption of XRP for cross-border payments or other applications may have influenced trading activity. It is also plausible that speculative trading or arbitrage opportunities have contributed to the volume surge.

However, the absence of a commensurate price increase raises questions about the underlying reasons for the elevated trading volume. A significant portion of the trading activity may be attributable to wash trading or other manipulative practices, which can artificially inflate volume without affecting the underlying price.

Alternatively, the influx of volume may be driven by short-term traders or speculators, who may quickly exit their positions, preventing a sustained price increase.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

To gain a more comprehensive understanding of the factors driving the XRP trading volume surge, it is essential to conduct a thorough analysis of on-chain data and trading patterns. This analysis should include an examination of order book depth, whale activity, and the distribution of trading volume across different exchanges.

Furthermore, investigating the correlation between XRP volume and other market indicators, such as Bitcoin price and overall market sentiment, can provide valuable insights into the underlying dynamics.

As the cryptocurrency market continues to evolve, understanding the factors influencing trading volume and price movements is crucial for investors and market participants. While the recent surge in XRP trading volume is undoubtedly noteworthy, it is essential to approach the development with caution and conduct further analysis to ascertain its implications.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News