The world of cryptocurrencies has been filled with uncertainty recently, and Ethereum (ETH), the second-largest digital currency, has taken center stage. After a promising surge earlier this month, ETH has stumbled in recent days, leading investors and analysts to speculate on its future.

Brandt’s Bearish Blizzard

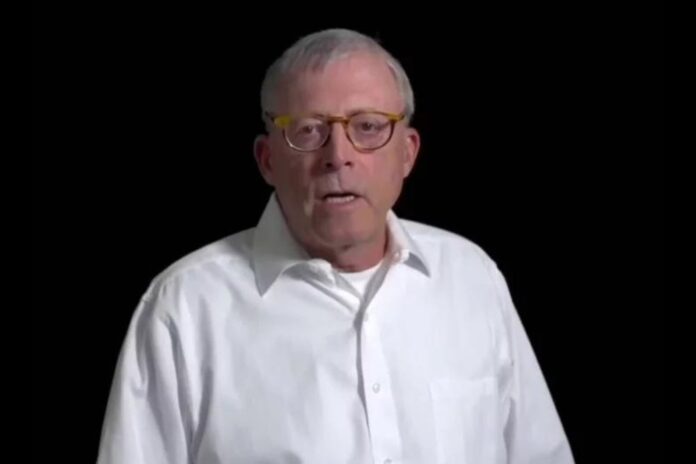

One influential figure making waves is Peter Brandt, an experienced trader known for his unconventional views and sharp technical analysis. Brandt has made a bold move by predicting that Ethereum (ETH) could plunge to $650 from its current price above $2,000.

Brandt’s argument is based on technical indicators on the Ethereum chart, which he believes indicate a bearish trend. Despite acknowledging the limitations of this analysis, Brandt remains confident in his forecast, suggesting that Ethereum could experience a substantial retracement, possibly reaching $1,000 or $650 as earlier mentioned.

Read Also: Veteran Peter Brandt Calls Traders’ Attention to this Bitcoin Head and Shoulder Pattern: Details

This bold stance has raised doubts among some investors, questioning whether Ethereum’s recent gains were merely an illusion.

Classical chart patterns in price charts are not sacred – they fail to perform according to the textbooks all the time

But, if the rising wedge in Ethereum $ETH complies with the script, the target is $1,000, then $650

I shorted ETH on Friday — I have a protective B/E stop pic.twitter.com/76CciT3PE5

— Peter Brandt (@PeterLBrandt) December 18, 2023

But is it all doom and gloom?

However, it is crucial to remember that the cryptocurrency market is highly unpredictable. While short-term corrections are common, Ethereum has notable factors working in its favor that counter Brandt’s narrative.

One such factor is the growing demand for an Ethereum Spot Exchange Traded Fund (ETF). This financial instrument, supported by major players like BlackRock, could pave the way for institutional investment, injecting a significant amount of capital into the Ethereum ecosystem and potentially driving up its price.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Beyond Brandt’s Barbs

As aforementioned, Brandt’s prediction is just one piece of the puzzle. Numerous factors can influence the price of Ethereum (ETH), including global economic trends, regulatory changes, and the ever-changing sentiment within the crypto community.

Relying solely on technical indicators, although valuable, may provide an incomplete understanding of asset price trajectory.

While Brandt’s bearish prediction may cause some concerns, it is essential to consider the bigger picture. Ethereum possesses strong fundamentals, driven by increasing institutional interest and ongoing technological advancements, which could ultimately propel it toward a brighter future.

Ultimately, the future of ETH remains uncertain, and investors should carefully evaluate all available information before making any investment decisions.

Follow us on Twitter, Facebook, Telegram, and Google News