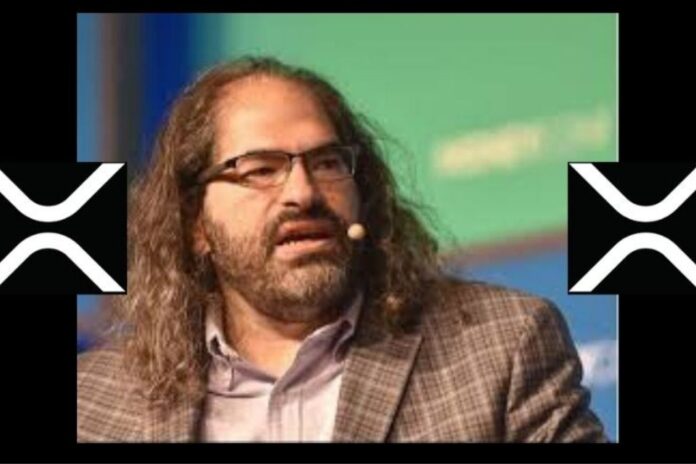

Ripple’s Chief Technology Officer (CTO) David Schwartz recently engaged in an exchange on X, challenging the notion of XRP holders being considered investors in Ripple. Drawing parallels with Amazon, Schwartz questioned whether individuals purchasing goods on Amazon could be deemed investors in the company.

The discussion originated from Schwartz’s comments on the OpenAI incident over the weekend involving the removal of Sam Altman as CEO.

Read Also: Ripple CTO David Schwartz Reveals Compelling Facts About Bitcoin (BTC)

Schwartz voiced concerns about a board not being accountable to investors and questioned the effectiveness of a corporate structure that excludes the CEO and employees from the upside of a multibillion-dollar tech company.

Most of the cash that fuels Amazon's biz operations comes from people who use their site to buy things from other people. Does that make them investors in Amazon?

— David "JoelKatz" Schwartz (@JoelKatz) November 21, 2023

A Different Perspective

Blockchain Maverick (@web3_maverick), a notable XRP supporter, provided a dissenting opinion, arguing that XRP holders should be recognized as investors in Ripple, citing the significant funding originating from XRP purchases.

He stated, “A board not accountable to investors sounds familiar, no? I would argue strongly that XRP holders are investors in Ripple, seeing as the majority of the cash that fuels biz operations comes from buyers of the token.”

Schwartz countered by emphasizing the analogy with Amazon. Schwartz questioned whether Amazon’s customers, who contribute to the vast majority of its revenue through third-party purchases, could be considered investors.

While some in the crypto community found the analogy fitting, others contended that it wasn’t an exact parallel, highlighting the difference in Amazon not manufacturing the products it sells. Schwartz dismissed this distinction, underscoring the common revenue source.

Although a notable crypto expert recently compared Ripple to Amazon, those comparisons focused on the early stages of each company and didn’t draw parallels between their business models.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Read Also: Ripple CTO Schwartz States When To Expect Real-World Asset Tokenization On XRP Ledger

However, Blockchain Maverick further contended that Ripple’s choice to release XRP instead of pursuing an Initial Public Offering (IPO) signaled an intent to benefit from XRP akin to companies gaining from an IPO. He also called out Schwartz for lying about the company’s intention of opting for token sales and not an IPO.

Schwartz clarified his perspective, revealing that he had always believed Ripple would generate revenue through an IPO, influencing his decision to choose Ripple stock over XRP as compensation. He also expressed surprise at the divergence from the anticipated IPO path, stating that anywhere else in the world, Ripple would be a public company.

Rumors of a Ripple IPO have been in the news lately, and we might soon see how the company reacts when it has to answer to shareholders as OpenAI does.

Follow us on Twitter, Facebook, Telegram, and Google News