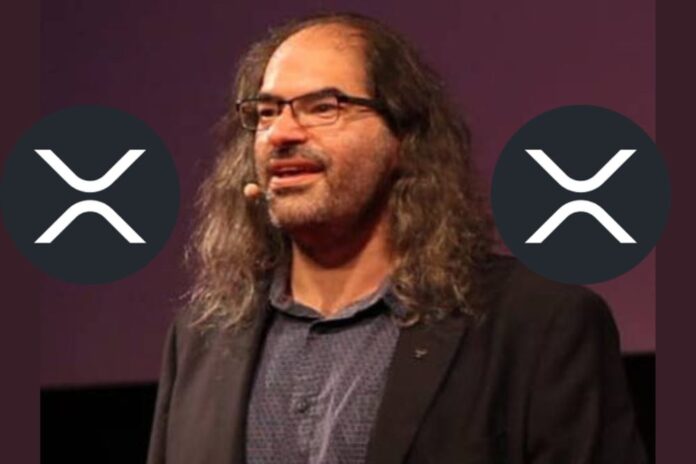

Ripple’s Chief Technology Officer, David Schwartz, has clarified that the mere fact that an asset was sold as an investment contract doesn’t make it a security. This statement adds further nuance to the ongoing debates following the ruling by Judge Analisa Torres in the SEC versus Ripple case.

Judge Torres’s decision, which came after a series of court proceedings, made the critical determination that Ripple’s XRP sales to institutional investors were considered securities, mainly because these investors were anticipating profits from the company.

Read Also: Ripple CTO: Digital Currencies Like XRP Could Challenge US Dollar as World Reserve Currency

However, she clearly differentiated these sales from the programmatic sales of XRP on secondary markets, stating that these were not securities since retail investors held different expectations.

David Schwartz’s latest comments have further elucidated this distinction. According to Schwartz, an asset’s classification as an investment contract at the time of its sale does not make it a security.

During these vigorous debates, Enumma’s CEO, David Barrera, contended that an individual acquiring a token in a secondary market might have expectations of profits from the token’s promoters. Schwartz strongly opposed this view, labeling it erroneous.

He referred to the SEC’s legal stance in the Bittrex case, highlighting inconsistencies in the claim that Bittrex sold and offered crypto assets suspected to be securities. In his words, “[…] That something was sold as a security doesn’t make it one.”

I don't think that claim is true. (For example, Howey has to buy orange groves to sell them. If successful, they'll add to the demand for groves.) But even if it was, it wouldn't render the SEC's legal theory coherent. That something was sold as a security doesn't make it one.

— David "JoelKatz" Schwartz (@JoelKatz) August 13, 2023

Schwartz’s point was further challenged by an X user, Jason Coombs, who drew attention to Howey’s sale of matured trees, not orange groves. Coombs explained that the Supreme Court in Howey recognized a row of trees containing an essential ingredient- a share in a common enterprise- as securities.

However, Schwartz countered that if Howey’s trees were sold without the accompanying rights or obligations, they wouldn’t be considered securities.

Read Also: Ripple Joins Bank for International Settlements (BIS) For Payments Taskforce. Can XRP Benefit?

Attorney John Deaton Shares Similar Opinion

The crux of Schwartz’s argument lies in his belief that selling an asset itself, without its contractual rights, doesn’t make it a security. This nuanced view is also shared by pro-XRP lawyer John Deaton.

Deaton acknowledges that Ripple might have offered XRP as a security in the past, but he emphatically contends that this action doesn’t inherently classify XRP as a security.

This ongoing discussion represents a complex and evolving understanding of securities within the crypto industry. While there may be differing opinions, the debate underscores the critical importance of legal definitions and the role they play in shaping the market dynamics of digital assets.

The thoughts expressed by key industry figures like Schwartz add depth to a debate that is sure to influence legal precedents and regulations in the rapidly changing world of cryptocurrency.

Follow us on Twitter, Facebook, Telegram, and Google News