According to the data provided by the crypto intelligence platform, IntoTheBlock, the total balance of Ethereum (ETH) on centralized exchanges has continued its massive decrease in 2022.

In a tweet on 1st February, IntoTheBlock revealed that a total of 302,092 ETH moved away from centralized exchanges in January 2022, amid the recent market downturn.

Read Also: Ethereum User Loses Over $500,000 Forever after Sending ETH to Wrapped Ether (WETH) Contract

IntoTheBlock tweeted, “ETH balance in exchanges continues to decrease. A total of 302,092 ETH left centralized exchanges just in 2022, according to IntoTheBlock Netflows Indicator The recent drawdown has increased the outflows from exchanges, at the same time as more ETH continues to burn (1.72m).”

$ETH balance in exchanges continues to decrease

A total of 302,092 ETH left centralized exchanges just in 2022, according to @intotheblock Netflows Indicator

The recent drawdown has increased the outflows from exchanges, at the same time as more ETH continues to burn (1.72m) pic.twitter.com/g4rGRbxlJP

— IntoTheBlock (@intotheblock) February 1, 2022

In January 2020, Ethereum (ETH) experienced its largest monthly price downtrend since March 2020, dipping with the flagship cryptocurrency in one of the worst-ever starts to a year for crypto markets.

However, despite the market downturn, Ethereum balances on exchanges continue to decrease massively. This implies that ETH investors are in for the long and this is good for the future of the cryptocurrency.

Read Also: Here’s Why Ethereum Co-Founder Will Receive Back $100M in SHIB Donated to Indian Crypto Relief Fund

At press time, Ethereum (ETH) is trading at $2,677, with a relatively 3% price downtrend in the last 24 hours. It’s worth noting that Ether has dipped by over 48% since attaining its price all-time high of relatively $4,890 on 16th November 2021.

Ethereum (ETH) Burned Surpasses 1.74 Million Worth $4.6 Million

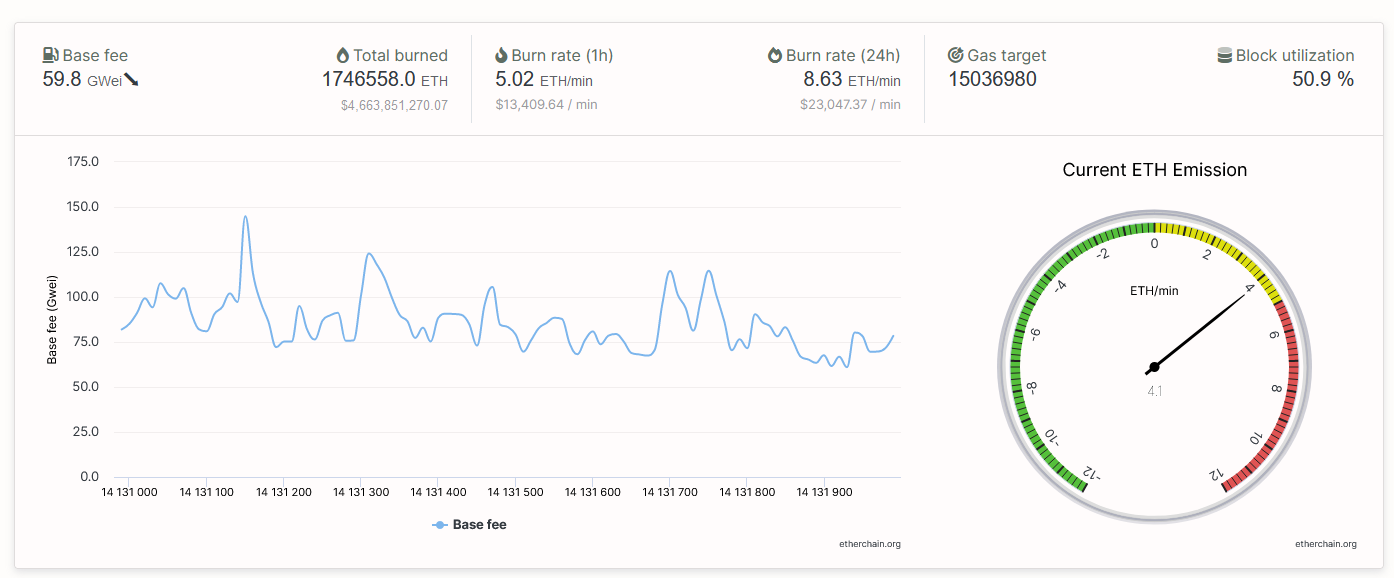

According to the data provided by Etherchain.org, over 1.74 million ETH worth $4.6 billion has been burned since the implementation of EIP-1559 in August 2021, which was part of the London hard fork.

Read Also: New York City Mayor Receives First Paycheck in Bitcoin and Ethereum via Coinbase

After the EIP-1559 protocol was introduced, the Ethereum fee market experienced a notable reformation. The upgrade changed the fee cap and introduced a burn function that permanently removes a percentage of transaction fees from Ether’s circulating supply.