XRP has consistently been a focal point in the cryptocurrency world due to its potential for transforming international financial transactions.

A recent post on X by Amelie (@_Crypto_Barbie), a notable figure in the crypto market, reignited discussions about XRP’s possible integration into traditional financial systems. In her post, she emphasized the growing likelihood of XRP playing a significant role in the global payment network.

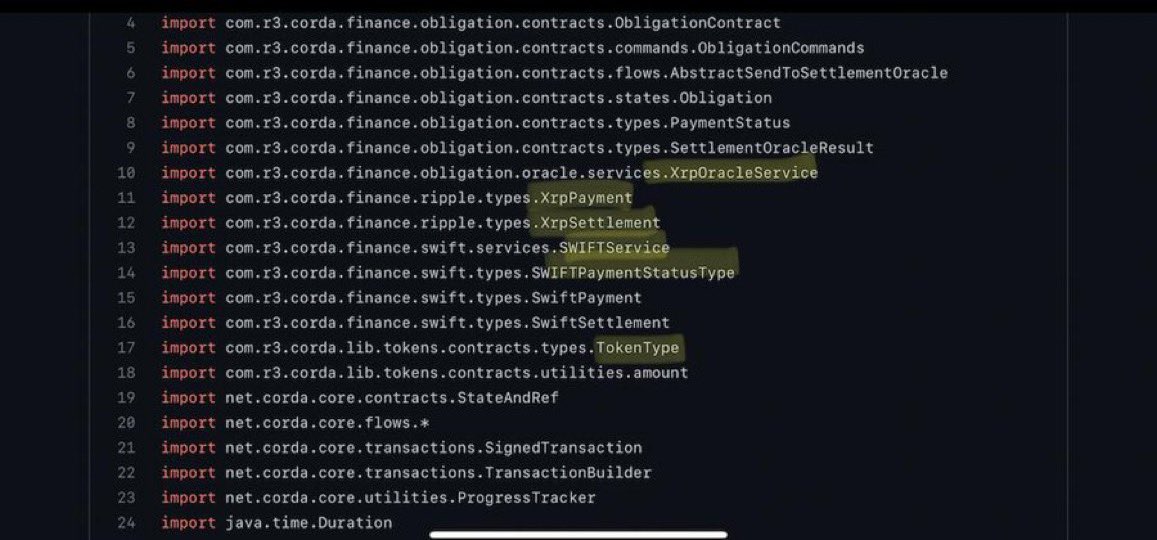

She attached an image showing lines of code suggesting that XRP had been tested within SWIFT’s framework. SWIFT, a messaging network that facilitates cross-border payments for more than 11,000 banks globally, has long dominated the international payment landscape.

The potential for XRP to be integrated into SWIFT’s system could have significant implications for the future of financial transactions, offering faster and more cost-effective solutions compared to traditional banking processes.

XRP to Take Over Cross-border Payments

The mention of XRP in this context isn’t entirely new. XRP was designed by Ripple to be a bridge currency that could facilitate instant and cost-efficient cross-border payments, which aligns with SWIFT’s objectives.

Should XRP gain a foothold within SWIFT, it could revolutionize the way transactions are processed on a global scale, reducing settlement times from days to seconds. This potential integration signifies an evolution in financial technology and a substantial shift in how traditional banks could operate in the future.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

BRICS’ Plans and XRP’s Strategic Position

Adding to XRP’s potential role within SWIFT is the geopolitical shift signaled by the BRICS nations. Russia announced intentions to move away from the U.S. dollar as the global reserve currency and to establish a crypto-based alternative financial system independent of Western influence. This strategic move could open a significant window of opportunity for XRP.

XRP’s technology, capable of seamless cross-border transactions positions it as a viable candidate for this new infrastructure. Its ability to settle payments in real-time and its existing partnerships with financial institutions enhance its attractiveness in a multi-polar global financial system.

The End of the SEC Lawsuit and XRP’s Future

XRP’s future looks even more promising following the conclusion of Ripple’s legal battle with the U.S. Securities and Exchange Commission (SEC). With the lawsuit now resolved, experts believe XRP will regain its momentum due to increased institutional interest, and additional factors like adoption by the BRICS bloc could help it reclaim its all-time high, and potentially more.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News