XRP is navigating a critical phase, with key resistance and support levels determining its next price action. This analysis examines XRP’s recent behavior across the daily, weekly, and monthly charts, offering insights for traders and investors looking for potential entry points, targets, and risk management strategies.

Monthly and Weekly Outlook

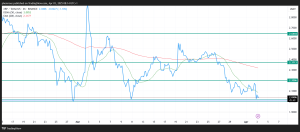

On the monthly chart, XRP has been trapped in a consolidation range between $2.00 and $2.20. This narrow price action signals market indecision. A break above $2.20 could trigger a bullish move towards $2.50, while a drop below $2.00 might push XRP back to $1.80 support.

On the weekly chart, XRP is holding above $2.02, which is key for maintaining upward momentum. Resistance at $2.94 remains the next hurdle. A move above this level could fuel a rally, while failure to maintain support at $2.02 could push the price towards $1.80, testing lower support at $1.50.

Daily Analysis

The daily chart shows a bearish head-and-shoulders pattern, with the neckline at $2.00. A breakdown below this level could lead to a decline towards $1.50. Technical indicators, including the RSI and MACD, also suggest waning bullish momentum, reinforcing the risk of further downside. However, a breakout above $2.20 would negate this pattern and could drive XRP higher, targeting $2.50 and $2.94.

Trade Setups: Entry, Take-Profit, and Stop-Loss

- Ideal Entry: Consider entering near $2.00, as it aligns with strong support, offering a favorable risk-to-reward setup.

- Take-Profit Levels: Target $2.20 (monthly resistance), $2.50, and $2.94 for potential bullish targets.

- Stop-Loss: Place a stop-loss just below $1.90 to manage downside risk if support breaks.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

XRP is at a crucial crossroads. A breakout above $2.20 could signal a shift towards higher levels like $2.50 and $2.94, while a failure to hold $2.00 could send the price lower, with $1.50 as the potential target.

Short-term traders can capitalize on the range between $2.00 and $2.20, while long-term investors should wait for a breakout confirmation above resistance. With proper risk management, XRP’s price action presents opportunities for both short-term and long-term strategies.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on X, Facebook, Telegram, and Google News