In a remarkable turn of events, XRP has shocked the community with an astounding 700% increase in fund inflows, solidifying its position as the standout performer among crypto investments in the past week.

According to CoinShares’ latest report, a staggering $700,000 flowed into XRP-related products within just one week. This surge reaffirms XRP’s dominance and represents a sevenfold surge in inflows into XRP Exchange Traded Products (ETPs) during that time.

The connection between the payment surge and the increased XRP inflow activity on the Bitstamp Exchange only adds to the intrigue. Activity like that usually signals a potential sell-off, but it could mean something else this time.

The surge in XRP inflows on Bitstamp could be linked to the growing adoption of Ripple payments, known as On-Demand Liquidity (ODL) before a rebranding.

It’s important to highlight that Ripple has partial ownership of Bitstamp and uses XRP in its payment services. The partnership between Ripple and Bitstamp might be the key factor driving the rising XRP investments and the series of XRP inflows into the exchange.

Inflows and Outflows for the Rest of the Market

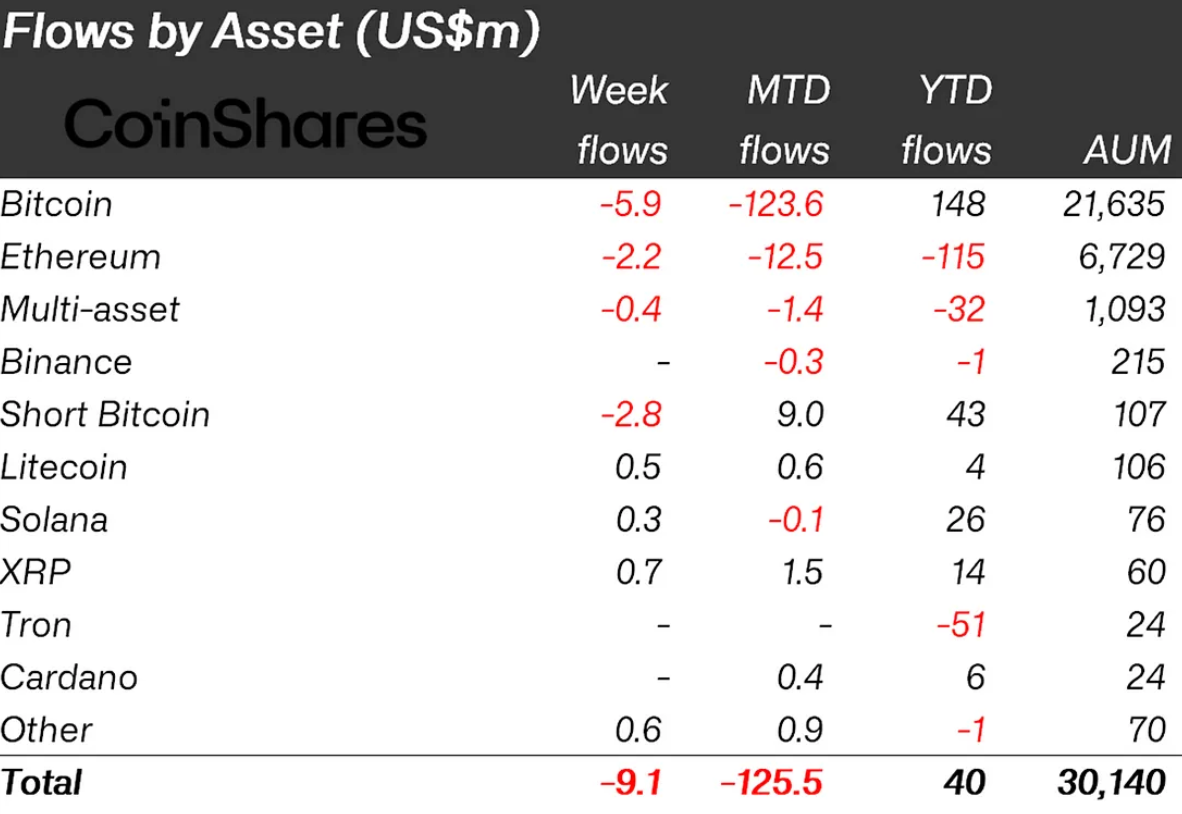

Although XRP has grabbed everyone’s attention, it’s worth noting that other cryptocurrencies also performed well. Solana (SOL) and Litecoin (LTC) saw substantial inflows into their ETPs, with $300,000 and $500,000 respectively.

Sadly, Bitcoin (BTC), Ethereum (ETH), and Short Bitcoin were in the red, with outflows of $5.9 million, $2.2 million, and $400,000, respectively. The report states that digital assets saw outflows totaling $9 million. This week was the 6th consecutive week with outflows from the market.

Read Also: Ripple Moves Millions of XRP To ODL Partner, Igniting Concerns Amidst Falling Prices

Ethereum is also down for the 6th week with the general market. Since the beginning of the year, the outflows have reached a substantial $125.5 million, with Bitcoin bearing the brunt of the market outflows.

The report shows a growing interest from investors in the altcoin market. It also highlights a difference in sentiment between European and U.S. traders, with European crypto investment products receiving $16 million in inflows, while U.S. products experienced $14 million in outflows.

This regional difference can be attributed to regulatory uncertainty because of the recent actions of the U.S. Securities and Exchange Commission (SEC). Furthermore, the report notes that weekly trading volumes have fallen below $820 million, a significant drop compared to the 2023 average of $1.16 billion

Follow us on Twitter, Facebook, Telegram, and Google News