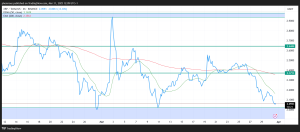

XRP is at a make-or-break moment as its price hovers around the crucial $2.00 support level. The recent 10% drop has raised concerns among traders, with the market showing signs of weakness. Currently, XRP is trading near $2.07, struggling to gain momentum amid selling pressure.

Market Overview

- Weekly Trend: XRP has entered a consolidation phase after a strong rally in late 2024.

- Daily Movement: The token faces selling pressure, limiting upward potential.

- Short-Term Analysis: Weak momentum on the 4-hour chart suggests difficulty in breaking resistance levels.

What If XRP Falls Below $2.00?

A breakdown below $2.00 could trigger a move toward $1.90, a level that previously acted as strong support. If selling pressure intensifies, XRP may slide further to $1.79, a key technical retracement zone. A worst-case scenario could see XRP testing $1.61 before buyers step in. Breaking these levels would signal a prolonged bearish phase, potentially leading to a deeper correction.

Factors Influencing Price Action

Several factors could impact XRP’s movement in the coming days:

- Bitcoin’s Performance: A drop in BTC could exert downward pressure on altcoins, including XRP.

- Regulatory Developments: Any news on Ripple’s ongoing legal matters could influence market sentiment.

- Market Liquidity: A lack of buyer interest may extend the correction phase, while increased volume could spark a reversal.

When Could XRP Recover?

For a rebound, XRP needs to hold above $1.90 and push past $2.10 to regain bullish momentum. A break above $2.25 would confirm strength and open the door for further gains. Additionally, market-wide sentiment, particularly Bitcoin’s movement, will play a major role in XRP’s recovery. Increased trading volume and improving RSI levels would signal potential upside movement. A successful move beyond $2.40 could reignite investor confidence, setting up XRP for another rally.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

XRP’s fate hinges on the $2.00 support level. Holding above it could spark a recovery, while a breakdown may lead to further losses. Traders should monitor volume, key resistance levels, and external market factors to anticipate the next major move.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on X, Facebook, Telegram, and Google News