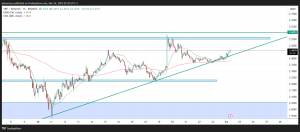

XRP has shown significant volatility over the past six weeks, trading within a $2.03 to $2.76 range. After reaching a high of $2.76 in mid-February, the cryptocurrency experienced a sharp pullback to $2.03 in early March. Since then, XRP has been in a recovery phase, stabilizing around $2.43 as of March 24, 2025.

Despite its recent recovery, XRP remains in a consolidation zone, with traders closely watching whether it can break above key resistance or slip into another downturn. This week will be crucial in determining the next major move.

Key Levels to Watch

Support Zones: The $2.03 level remains a critical floor, with $2.00 serving as a psychological barrier. A break below this region could lead to deeper losses, with potential support forming around $1.90.

Resistance Zones: The primary resistance level is $2.50. If XRP clears this hurdle, the next target would be $2.76, its recent high. A breakout above this could set the stage for a push toward $3.00.

Trend Analysis: XRP is currently hovering near its 50-day moving average, reflecting market indecision. A sustained move above $2.30 supports a bullish continuation, while a drop below this could shift momentum in favor of the bears.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Price Prediction for the Week

XRP’s short-term outlook depends on whether it can maintain support or gain enough momentum for a breakout. Here are the two possible scenarios:

- Bullish Outlook: If XRP reclaims $2.50, it could challenge $2.76 again. A breakout above this resistance could ignite further buying pressure, potentially driving the price toward $3.00.

- Bearish Outlook: If XRP struggles to stay above $2.30, it may slide toward $2.10. A failure to hold this level would increase the risk of testing $2.00, which would be a crucial support zone.

XRP is currently at a crossroads, trading within a tight range between $2.30 and $2.50. A decisive move beyond these levels will dictate the next major trend. Traders should watch these critical price points closely, as a breakout could spark a rally, while a breakdown may lead to further downside pressure.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on X, Facebook, Telegram, and Google News