The World Bank has highlighted XRP as a leading digital currency for cross-border transactions. This endorsement, shared on X by Levi (@LeviRietveld), positions XRP as a critical player in the global payments industry, specifically for international money transfers.

The recognition of XRP by the World Bank shows the growing importance of digital currencies in transforming the financial sector, particularly in facilitating cross-border payments. The choice of XRP as a suitable currency for these transactions highlights its efficiency, speed, and cost-effectiveness, which are crucial factors in international money transfers.

The endorsement reflects the potential of XRP to streamline and modernize the global payments infrastructure, offering a viable alternative to traditional banking systems that often involve lengthy processes and high fees.

Ripple designed XRP to be more than just a digital asset. It’s to serve as a bridge currency in Ripple’s network, enabling seamless transactions across different fiat currencies. This capability is valuable for multinational corporations and financial institutions that require efficient and reliable cross-border payment solutions.

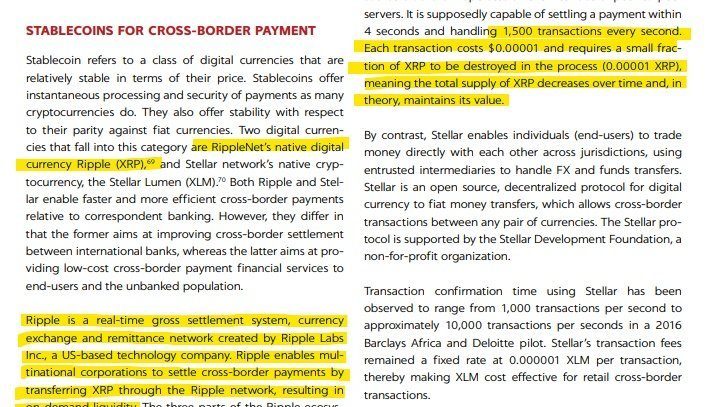

Levi’s document shows that Ripple’s system can handle 1,500 transactions per second with just $0.0001 transaction cost. Additionally, a small fraction of XRP (0.00001 XRP) is destroyed, which theoretically helps maintain its value over time.

A perfect example of XRP’s capabilities is a transfer made by Arrington Capital. According to the CEO Michael Arrington, the company transferred $50 million in 3 seconds at $0.3.

In the context of cross-border payments, XRP often finds itself compared with Stellar (XLM), another digital currency designed for international transfers. While both currencies aim to improve the efficiency of cross-border transactions, their approaches differ.

XRP primarily serves financial institutions and large corporations, offering a real-time payment settlement system. On the other hand, Stellar Lumens is more geared towards individual users, providing a platform for transferring money across borders through decentralized exchanges and trusted intermediaries.

XLM’s transaction costs are similar to XRP’s, with a fixed rate of 0.00001 XLM per transaction. However, XRP could play a more significant role as it serves larger institutions that can provide a broader range of services.

The World Bank’s selection of XRP as a preferred currency for cross-border transactions is a milestone that reinforces the digital asset’s potential to revolutionize international payments. XRP’s potential is gaining increasing recognition, as experts believe it is the top choice for the BRICS coalition which has announced plans for a crypto-based SWIFT alternative.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News

When momentum kicks in, Bitcoin never disappoints. Hovering around $82,600, Bitcoin has its eyes set…

In a landmark development for the cryptocurrency market, Bitnomial, a prominent digital asset derivatives exchange,…

Shiba Inu (SHIB) is currently trading at $0.00001285, reflecting a slight price movement of 0.02839%.…

The meme coin market is as unpredictable as ever, and the latest shift in sentiment…

Yoshitaka Kitao, Chairman and CEO of SBI Holdings, reaffirmed his confidence in Ripple’s future during…

XRP has experienced notable price fluctuations in recent days, drawing increased attention from traders and…