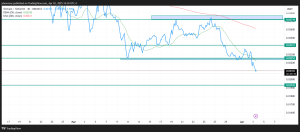

VeChain (VET) has been experiencing volatility, with its price currently hovering around $0.021. The asset has faced a decline of approximately 6.64% in the past 24 hours, prompting traders to closely examine its support and resistance levels across different timeframes.

On the weekly chart, VET is in a downtrend, nearing a critical support level at $0.0200. A breakdown below this mark could accelerate bearish momentum, possibly pushing the price toward $0.0180. However, if buyers defend this level, a rebound could initiate an upward recovery toward the $0.0250 resistance zone.

The daily chart indicates consolidation, with VET trading between the $0.0225 support and $0.0235 resistance. A decisive breakout above $0.0235 could pave the way for a move toward $0.0250 and beyond. Conversely, a drop below $0.0225 might result in a pullback to $0.0218.

On the 4-hour chart, VET is forming a falling wedge pattern—a bullish reversal indicator. The price is approaching the wedge’s lower trendline near the $0.0200 support. A breakout above the wedge could trigger a bullish rally toward $0.0250.

The 1-hour chart shows immediate resistance at $0.0479. A breakout above this level could push the price towards $0.0489 and $0.0515. Key support lies at $0.0433, and holding above this level is crucial for bullish momentum.

With key support at $0.0200 and resistance at $0.0235, VET’s price action suggests a critical decision point. Traders should monitor these levels closely, as a breakout could signal a strong directional move. Implementing risk management strategies is essential in this volatile market.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on X, Facebook, Telegram, and Google News

Have you ever kicked yourself for not scooping up Monero when it was just pennies?…

Anticipation is building within the XRP community, as new signals point toward an exciting announcement…

Bitcoin is flashing a major bullish signal as key on-chain data points to intensified investor…

The idea of a "Great Reset" has long hovered at the edges of financial and…

After months of uncertainty, April 2025 is giving crypto investors a reason to smile again.…

Top meme coins like Shiba Inu (SHIB) and Dogecoin (DOGE) have recorded notable gains as…