XRP has recently experienced a price increase, and technical indicators suggest the potential for a significant upward trend. Specifically, the Bollinger BandWidth (BBW) and Aroon indicators are exhibiting signals historically associated with substantial XRP price rallies.

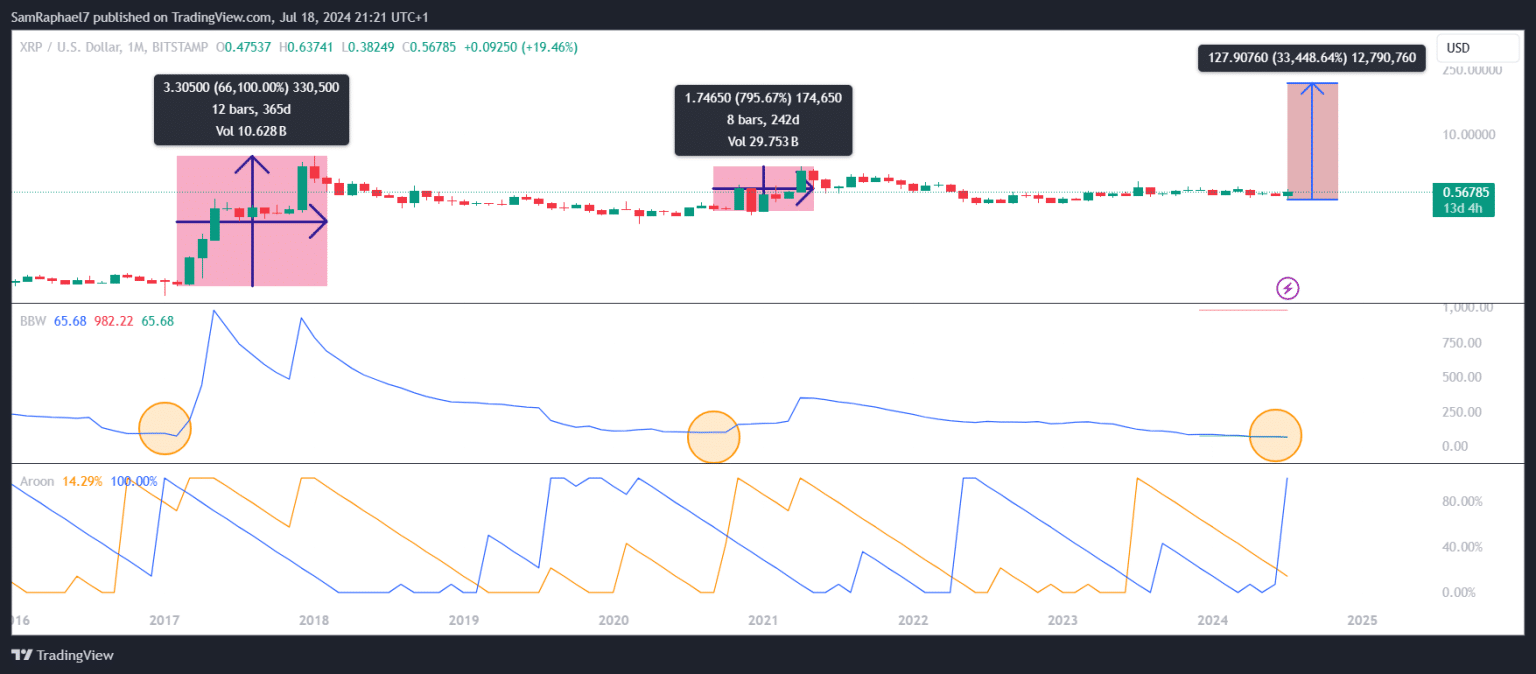

The BBW measures market volatility. An extremely low BBW, like the one XRP is currently experiencing (65.69, the lowest in its history), often precedes a period of high volatility and price movement.

Aroon indicators, on the other hand, track the strength of trends. In the current scenario, the Aroon Up indicator has fallen sharply (14.29%), while the Aroon Down has reached 100%. This divergence suggests a potential reversal from a downtrend and the emergence of an uptrend.

Historical Precedents

Similar BBW and Aroon readings preceded significant XRP rallies in 2017-2018 and 2020-2021. In February 2017, a low BBW (73.40) coincided with a weak Aroon Up (71.43%) and a strong Aroon Down (92.86%). Following these signals, XRP bottomed out at $0.005 before undergoing a remarkable 66,100% surge to $3.31 in January 2018.

The pattern repeated in late 2020. A low BBW (100.42) emerged alongside a declining Aroon Up (42.86%) and a rising Aroon Down (50%). XRP subsequently skyrocketed by 795% from its bottom price to a peak of $1.96 in April 2021.

Potential Price Surge

Based on the historical performance following similar technical setups, analysts project a potential surge for XRP. An analysis of the average gains from past rallies suggests a possible increase of 33,448%. This would propel XRP from its recent low of $0.3824 to a price of $128.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Supporting Trends

Several additional trends support the bullish outlook for XRP. First, the recent 19.46% price increase in July could be the initial phase of the predicted upswing. Second, the tightening of the Bollinger Bands on the monthly chart reinforces the possibility of substantial price movement. Tight bands often precede significant price volatility.

Third, on-chain data from Santiment indicates an accumulation trend among large investors. Specifically, addresses holding between 100,000 and 10 million XRP have acquired 130 million XRP since June.

Additionally, wallets containing at least 1 billion XRP have amassed a significant amount (1.15 billion XRP) within the same timeframe. This institutional accumulation suggests growing confidence in XRP’s future potential.

While past performance is not necessarily indicative of future results, the current technical indicators for XRP share similarities with periods preceding past rallies. Combined with on-chain data suggesting investor accumulation, these factors create a scenario suggesting a future upswing for XRP.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News