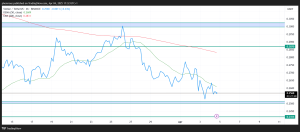

Stellar (XLM) is currently trading at $0.2571 on the 4-hour timeframe against USDT on Binance. The price is fluctuating within a tight range, facing resistance and struggling to break out of its downward trend. With significant support at $0.2414 and a key resistance level at $0.2870, traders are looking for signals to determine whether a breakout or further decline is imminent.

Key Support and Resistance Levels

- Immediate Support: $0.2414

- Immediate Resistance: $0.2870

- Major Resistance Above: $0.3000

XLM is hovering near a crucial support zone at $0.2414, which has acted as a floor for recent price action. A break below this level could open doors for further downside, while a move above $0.2870 could trigger a short-term rally.

Technical Indicators & Trend Analysis

- 50-period DEMA (Double Exponential Moving Average): Acting as dynamic resistance, keeping the price suppressed.

- 200-period EMA (Exponential Moving Average): Positioned above the price, confirming the overall bearish trend.

- Downtrend Formation: The price has been making lower highs and lower lows, signaling continued weakness.

Bullish vs. Bearish Scenario

- Bullish Case

- If XLM breaks above $0.2870, the next target would be $0.3000.

- A breakout above $0.3000 could shift momentum bullish, potentially aiming for $0.3200.

- Buyers need to reclaim the 200 EMA for sustained upward movement.

- Bearish Case

- A break below $0.2414 could trigger a sell-off toward $0.2200.

- Sustained bearish pressure could push XLM below $0.2000, leading to deeper correction levels.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Prediction: What’s Next for XLM?

With the price currently below both key moving averages, the trend remains bearish unless bulls reclaim resistance levels. If XLM holds above $0.2414, a bounce toward $0.2870 is possible. However, if sellers push it below $0.2414, expect a further drop toward $0.2200 or lower.

Traders should watch for volume confirmation and key price reactions at support and resistance levels before making their next move.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on X, Facebook, Telegram, and Google News