As bullish momentum propels the crypto market, XRP has demonstrated notable gains. Further upward movement is anticipated, with advanced machine learning algorithms predicting a significant XRP price increase.

Price Prediction and Analysis

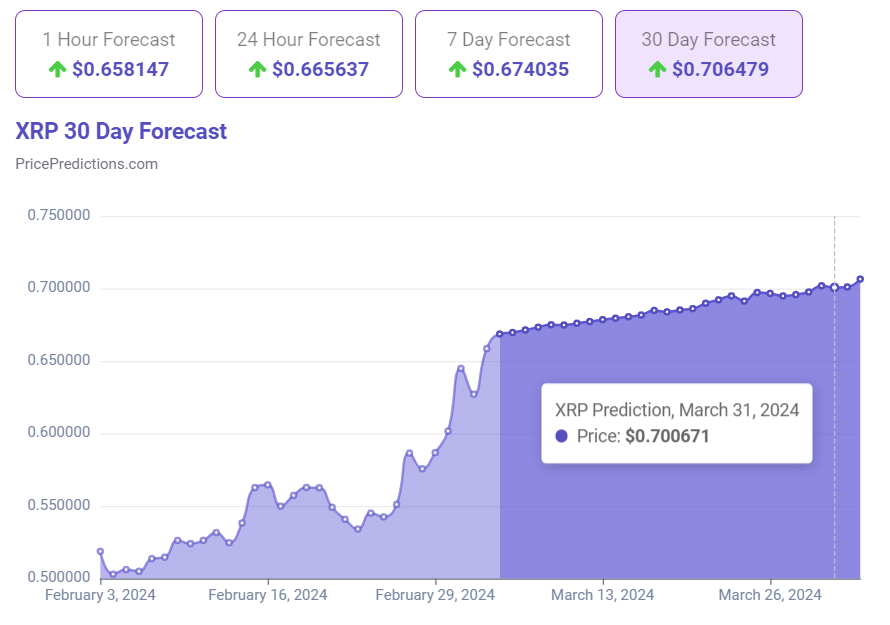

Crypto analytics and forecasting platform PricePredictions utilizes sophisticated algorithms, including technical indicators such as relative strength index (RSI) Bollinger Bands (BB), moving average convergence divergence (MACD), and average true range (ATR).

Read Also: State-of-the-Art Machine Learning Algorithm Sets XRP Price for March 1, 2024

According to the data, XRP could reach $0.706479 by March 31, 2024, signifying an approximately 20.72% gain from its current value. XRP’s recent price performance demonstrates a bullish trend with positive long-term technical analysis.

Market sentiment toward XRP remains highly optimistic across various time frames. Oscillators and moving averages signal a ‘strong buy’, further bolstering the bullish outlook.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Factors Influencing XRP’s Trajectory

Ripple vs. SEC Legal Battle: The ongoing legal dispute between Ripple and the SEC casts a significant shadow over XRP. Positive developments, such as favorable rulings, tend to boost investor confidence, while negative updates can dampen sentiment and lead to price declines.

Crypto Market Sentiment: XRP’s price often aligns with the broader cryptocurrency market. Bullish periods can lift XRP along with other assets. Conversely, bearish market trends can create downward pressure on XRP’s price.

XRP Adoption and Use Cases: Growing adoption and practical applications of XRP drive demand and influence price. Increased use for cross-border payments, partnerships with financial institutions, or integration into new platforms strengthens XRP’s position and reflects positively on its value.

Network Activity and Burn Rate: A surge in transactions on the XRP Ledger often indicates increased usage and can signal higher demand. Additionally, the XRP burn mechanism, where a small amount of XRP is permanently removed from circulation with each transaction, can create a subtle deflationary effect, potentially supporting price action.

Global Economic Conditions: Like other assets, XRP can be sensitive to macroeconomic trends such as inflation, interest rates, and geopolitical events. Economic uncertainty may lead investors towards more traditional safe-haven assets, potentially impacting XRP’s price.

Read Also: Machine Learning Algorithms Set XRP Price for January 31

Important Disclaimer

While machine learning algorithms offer valuable insights, it’s essential to remember that the cryptocurrency market is inherently volatile. XRP’s price trajectory will be influenced by broader market trends, news surrounding Ripple’s legal case, and other factors. Before making investment decisions, readers are strongly encouraged to conduct comprehensive research and consider their risk tolerance.

Follow us on Twitter, Facebook, Telegram, and Google News