XRP has garnered significant attention in recent months. Following the recent crypto market resurgence caused by Bitcoin’s recent surge, many traders hold onto the hope that XRP will finally reclaim its past glories. However, despite these positive indicators, XRP has underperformed, falling 3.68% over the past 24 hours to $0.542.

While the broader crypto market witnessed a surge, XRP is lagging. In 2024 alone, the digital token has even dipped by almost 14%. Many investors are still bullish despite the appalling performance, with one Bitcoin investor recently picking up $500,000 worth of XRP.

Read Also: Machine Learning Algorithms Set XRP Price for January 31

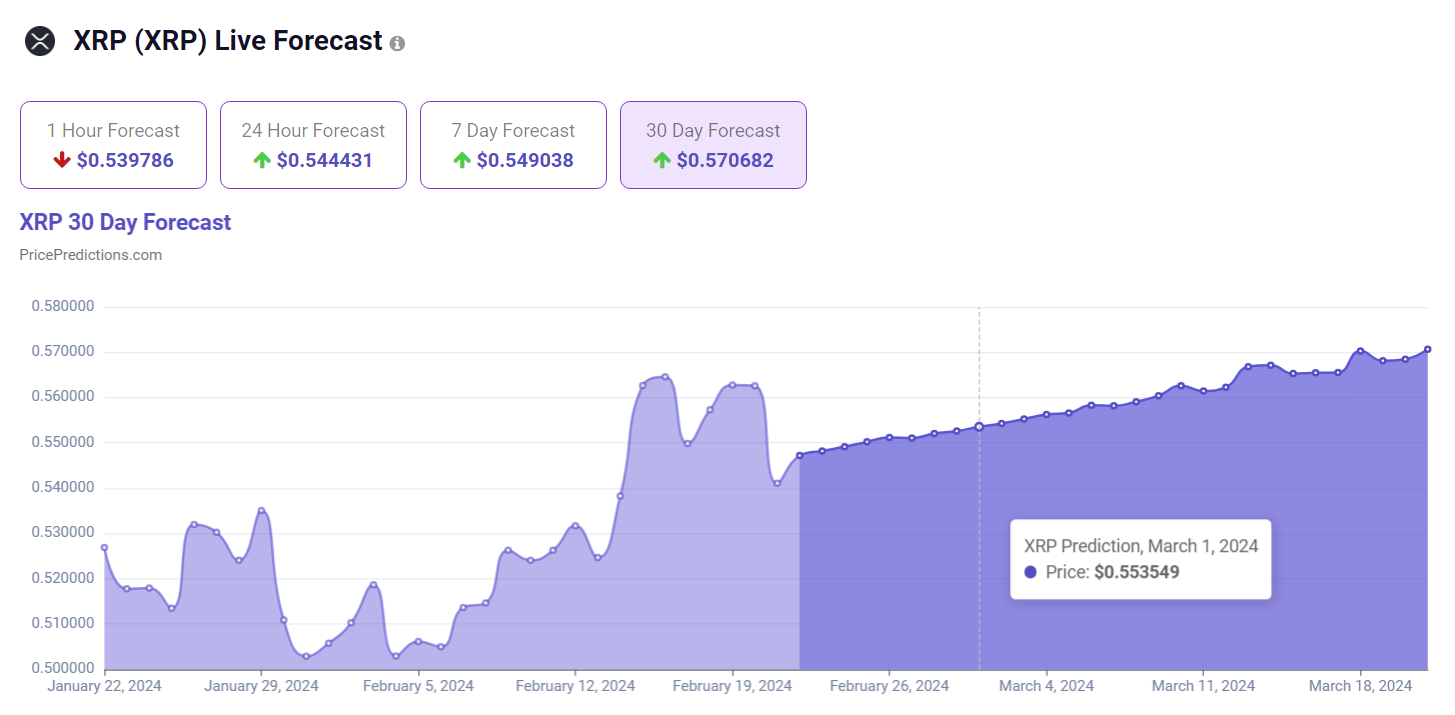

Faced with this mixed bag of signals, We sought insights from PricePredictions, a platform utilizing AI-driven machine learning algorithms to forecast cryptocurrency prices. The analysis focused on XRP’s potential performance over the next 10 days.

AI Hints at Short-Term Climb

According to PricePredictions’ algorithms, XRP might finally inch upward in the coming days. The prediction model suggests an increase to $0.553549 by March 1, 2024. Furthermore, the AI anticipates this uptrend to continue into mid-March, with XRP potentially reaching $0.570682, representing a 5.29% increase within 30 days from its current price.

However, a closer look at technical indicators based on XRP’s recent performance paints a contrasting picture. The token’s short-term outlook leans towards selling. It should be noted that Oscillators and moving averages predominantly signal a sell recommendation, particularly based on the last 24 hours of trading.

This discrepancy between AI predictions and technical indicators underlines the uncertainties associated with cryptocurrency price movements. While AI algorithms analyze vast amounts of historical data and market trends, they cannot account for unforeseen events or sudden shifts in investor sentiment, both of which can significantly impact prices.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Read Also: Here’s Why Ben Armstrong (Bitboy) Sets $7 XRP and $1,000 Solana (SOL) For 2024

Other factors could also impact XRP in the short term. The most significant of these is the ongoing legal battle between Ripple and the SEC. This lawsuit has hampered XRP’s price and adoption in the U.S. since it began in December 2020, and unforeseen outcomes could significantly affect XRP.

Beyond the legal battle, broader market forces also play a crucial role. The overall health of the cryptocurrency market, particularly Bitcoin’s performance, can significantly impact XRP’s price movement.

Ultimately, predicting XRP’s long-term price trajectory remains a challenging endeavor. However, a Ripple executive has revealed that the company prioritizes utility and adoption over short-term price movements, showing that the company has bigger plans for the digital asset.

Follow us on Twitter, Facebook, Telegram, and Google News