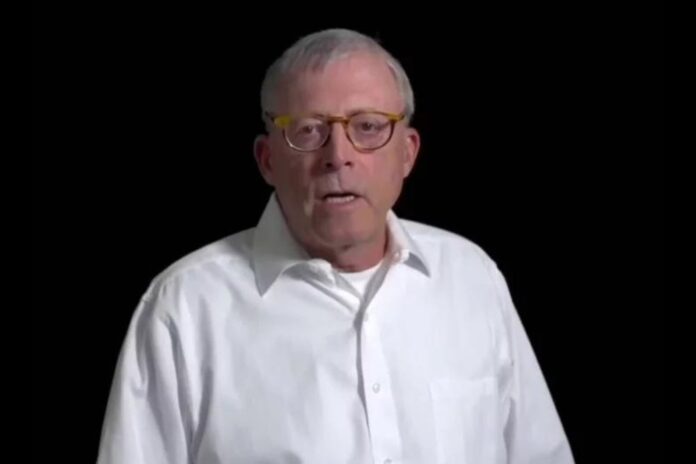

Veteran commodities trader Peter Brandt, known for his decades of market expertise and sharp insights, has shared details about his cryptocurrency portfolio while making bold predictions about the market’s future.

Brandt has been a prominent voice in the trading community offering commentary on market trends and his personal investment strategies.

Brandt Holds Bitcoin and Solana but Looks Elsewhere for Profits

Brandt has revealed that he owns Bitcoin, the leading cryptocurrency, and Solana (SOL), an Ethereum competitor often called an “ETH killer.” Despite holding these two assets, he has tempered expectations regarding their potential for dramatic price increases.

Brandt noted that Bitcoin’s meteoric rise—from $0.07 in January 2010 to its recent trading levels above $100,000—has fueled speculation among millennial and Gen Z investors. However, he cautioned against expecting similar gains in the future, suggesting that the days of exponential growth for Bitcoin and other digital assets are likely over.

Interestingly, Brandt disclosed that his current investment focus is not on cryptocurrencies but on traditional equities. He specifically cited purchasing shares in Kimberly-Clark, the company behind Kleenex as an example.

While his statement could imply a broader preference for the stock market, Brandt acknowledged that some crypto enthusiasts might label him a crypto hater for his views.

Warnings of a Major Market Correction

In addition to outlining his holdings, Brandt issued a stark warning about the cryptocurrency market. He anticipates a significant correction for Bitcoin, estimating a potential decline of 50%. His outlook for altcoins and meme coins is even more severe, forecasting losses of 90% and 100%, respectively.

Although he did not provide a specific timeline, his remarks suggest these events could unfold soon, possibly in 2025. As of now, Bitcoin has experienced a recovery, rising by 4.04% over the past 24 hours to its current price of $102,028.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Context for Brandt’s Skepticism

Brandt’s skepticism toward cryptocurrencies reflects his broader investment philosophy, prioritizing long-term sustainability over speculative gains.

While he has previously acknowledged the transformative potential of blockchain technology, he has consistently urged caution regarding speculative investments in digital assets, particularly those lacking clear utility or adoption.

Peter Brandt’s latest commentary highlights the challenges facing the cryptocurrency market as it matures. While his decision to hold Bitcoin and Solana indicates confidence in their staying power, his shift toward traditional equities and warnings of a market downturn serves as a reminder of the volatility inherent in digital assets.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News