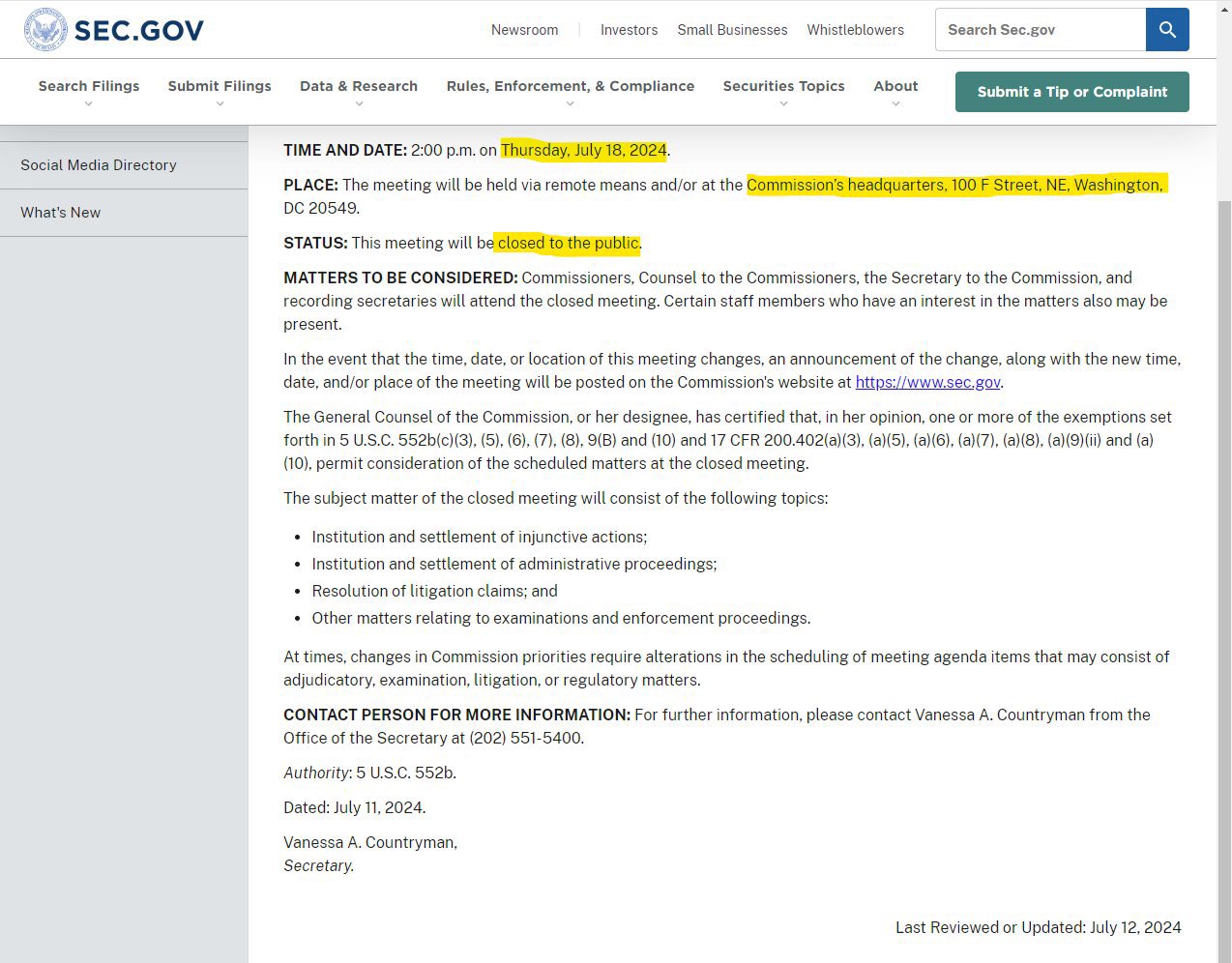

The Securities and Exchange Commission (SEC) is holding a closed-door meeting today, July 18th, 2024. The meeting focusing on enforcement actions, including initiation and settlement of legal actions and administrative proceedings, has sparked significant interest, particularly regarding the ongoing lawsuit between the SEC and Ripple Labs.

While the specific topics remain confidential to protect sensitive investigations and market stability, the nature of the meeting suggests the SEC might be nearing settlements or making progress in its enforcement efforts. This has led to speculation, particularly concerning the high-profile case against Ripple Labs, a blockchain company that majorly distributes XRP.

Crypto Barbie, a cryptocurrency enthusiast, has generated a lot of responses due to her question about the likelihood of a Ripple-SEC case settlement occurring via this meeting.

An X user, @batman_XRP, responding to Crypto Barbie’s question, expressed his skepticism about a settlement occurring. He said, “I don’t, I think @Ripple is taking it to the SEC and letting the judge rule on it to make the SEC eat crow and possibly not having to pay them anything based off the corruption surrounding the filing of the lawsuit in the first place that the judge is filly aware of at this point !”

SEC Lawsuit Implications

The SEC’s December 2020 lawsuit alleges XRP to be an unregistered security, a claim vehemently denied by Ripple Labs. The outcome of this case holds immense weight for the cryptocurrency industry, potentially shaping how cryptocurrencies are regulated.

A win for the SEC could introduce significant hurdles for companies developing and selling cryptocurrencies. Conversely, a Ripple Labs victory might provide much-needed clarity on the regulatory landscape for these digital assets.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

However, it’s crucial to remember that the SEC meeting is just one piece of a complex legal puzzle. The final verdict will hinge on various factors, including the evidence presented by both parties and the court’s rulings. Stakeholders in the cryptocurrency industry will undoubtedly be following the developments closely as the case unfolds.

Beyond the Ripple case, the SEC’s closed-door meeting underscores its ongoing commitment to safeguarding investors and maintaining market integrity through robust enforcement actions.

These actions can take various forms, including imposing sanctions, pursuing civil penalties, or seeking injunctive relief. The details of today’s meeting might remain undisclosed, but its occurrence signifies the SEC’s proactive approach to upholding market regulations.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News