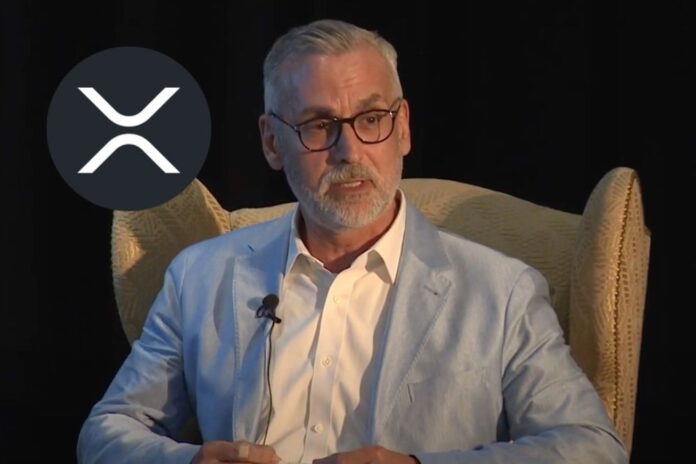

Stuart Alderoty, the Chief Legal Officer of Ripple, has made a pointed critique against the U.S. Securities and Exchange Commission (SEC), emphasizing what he perceives as a misleading use of terminology in a legal filing.

Alderoty specifically targeted the term “crypto asset security,” which appears in the SEC’s recent filings related to the FTX bankruptcy case. According to Alderoty, this term has no legal grounding in any statute and the SEC created it to influence judicial decisions.

Alderoty shared screenshots of the SEC’s filing, where the agency asserts its rights concerning the distribution of assets, including crypto-asset securities, under the FTX bankruptcy plan.

The filing, dated August 30, 2024, and submitted to the U.S. Bankruptcy Court for the District of Delaware, outlines the SEC’s position on the proposed Chapter 11 plan for FTX.

The SEC highlights that the debtor’s portfolio includes crypto asset securities, which could be monetized or distributed according to the plan. However, Alderoty argues that the SEC’s use of the term “crypto asset security” is misleading and legally unfounded.

The SEC’s filing also mentions the possibility of distributing stablecoins to creditors as part of the bankruptcy plan. The agency notes that the term “cash” has been defined to include U.S. dollar-pegged stablecoins, which could play a role in the distribution process.

However, Alderoty’s focus remains on the broader implications of the SEC’s language, particularly the potential for this terminology to shape legal interpretations in a way that might not align with established law.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Are Crypto Assets Securities?

Alderoty’s critique reflects broader concerns within the cryptocurrency industry about regulatory overreach and the SEC’s approach to digital assets. By coining and using terms like “crypto asset security,” the SEC, in Alderoty’s view, is attempting to extend its regulatory jurisdiction without clear legislative backing. This, he argues, creates confusion and could lead to judicial decisions that lack a solid legal foundation.

XRP suffered greatly and Ripple had to sit through years of litigation because of the SEC’s desire to label XRP as a security. Ultimately, the SEC failed in this endeavor, but this has not completely stopped their actions in other lawsuits.

By challenging the SEC’s language and its implications, Alderoty is not only defending Ripple’s interests but also advocating for clearer and more consistent regulatory frameworks for the cryptocurrency industry as a whole.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News