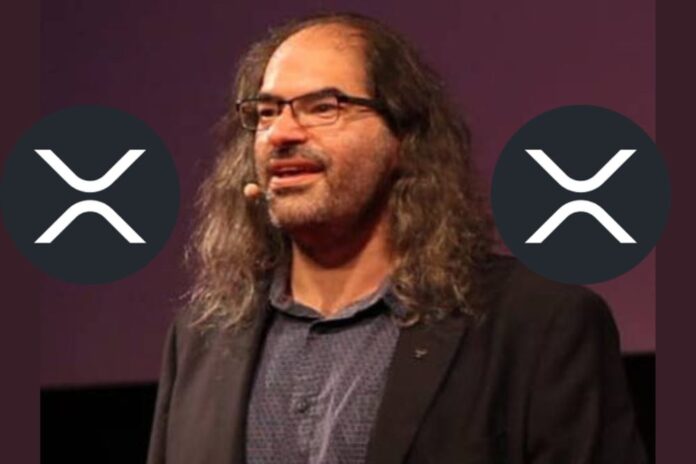

The debate about XRP’s true value has reignited within the crypto community following a rediscovery of historical statements made by Ripple CTO, David Schwartz. These remarks, dating back to 2018, surprisingly present a perspective on XRP that may leave some scratching their heads.

The question on the mind of the community right now is whether XRP’s value proposition truly mirrors that of Bitcoin, or if it is fundamentally distinct.

Read Also: Ripple CTO David Schwartz Reveals Five Exciting Predictions for 2024

In a back-and-forth on X from 2018, Ari Paul, founder of BlockTower Capital, ignited the debate by challenging XRP’s perceived utility for financial institutions, particularly in cross-border payments.

He questioned the incentive for banks to adopt XRP when they could reap potential rewards by developing their solutions themselves.

He wrote, “My primary argument is that banks will not use an asset primarily owned by a third party to create hundreds of billions of value from thin air as a global reserve when they can easily own that newly created wealth.”

Meanwhile, The Central Bank of Germany recently highlighted Ripple and the potential of XRP in a report, showing the value it can bring to the banking system.

David Schwartz’s Response

Schwartz, however, vigorously defended XRP, dismissing Paul’s argument of someone else cloning XRP. He asserted that simply replicating XRP wouldn’t guarantee similar success, citing the unique dynamics of the crypto market and the community’s resistance to bank-controlled currencies.

The idea that any group can just clone an asset and easily have a lead, however, is absolutely absurd. It hasn't worked for bitcoin or ethereum and I can't see it working for XRP. Who wants a crypto run by banks? 3/3

— David "JoelKatz" Schwartz (@JoelKatz) October 5, 2018

Schwartz’s point highlighted a crucial divergence between XRP and Bitcoin. XRP’s value hinges on adoption by centralized institutions, while Bitcoin thrives as a decentralized alternative.

Interestingly, Schwartz drew a parallel between XRP and Bitcoin’s value propositions, emphasizing their shared utility in facilitating transactions. However, he underscored XRP’s advantages in terms of speed, cost, and suitability for cross-border payments.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Read Also: David Schwartz Addresses 10 Common Misconceptions About Ripple and XRP

XRP’s Poor Performance

These comments were brought to the community’s attention by Good Morning Crypto (@3TGMCrypto). However, the community did not react favorably. Despite these assertions of XRP’s value, the community remains vocal about their growing frustration.

XRP has been unable to reclaim its all-time high from January 2018, and with the price languishing below $1 despite these purported advantages, users expressed exhaustion and disappointment.

While the historical discussion offers valuable insights, it fails to address the immediate concerns of those invested in XRP’s future. However, a prominent analyst recently predicted a surge to $27 in the next bull cycle. 2024 could be the year when XRP rewards its faithful holders.

Follow us on Twitter, Facebook, Telegram, and Google News