Discussions about the decentralized nature of the XRP Ledger (XRPL) were reignited recently when Vet, a validator on the Ledger, introduced a contentious idea: doubling the total supply of XRP from 100 billion to 200 billion tokens.

This proposal was ultimately rejected by the XRPL Foundation (XRPLF). It has sparked debate across the XRP community, highlighting the open, decentralized decision-making process of blockchain technology.

Despite the rejection, Vet took it a step further and released a modified version of Ledger’s software, allowing node operators to run a forked version of the network. This move raised questions about the role of validators, the potential for forks, and the broader implications of altering a blockchain like XRPL.

At the heart of the debate was the concept of decentralization. By proposing the supply increase, Vet sought to emphasize that the future of XRP is not dictated solely by Ripple or the XRPLF, but rather by the consensus of validators, exchanges, and node operators.

His actions underscored one of blockchain’s fundamental principles: the ability to fork the network if stakeholders cannot reach an agreement.

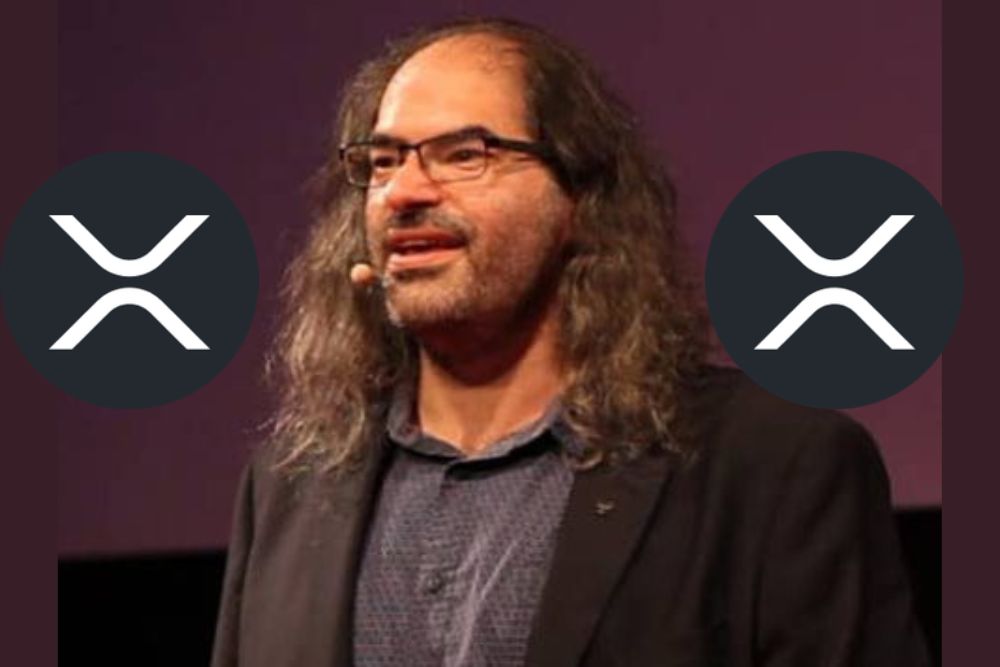

Ripple CTO David Schwartz provided his perspective, confirming that the decentralized nature of XRPL means no single entity can impose changes on the entire network, underscoring the ability of validators to decide for themselves which software they wish to run.

This further highlighted the fact that the control of XRPL’s future is distributed among the network’s participants.

David Schwartz noted, “He can’t force anyone else to accept his changes but neither can anyone else stop anyone who wants his changes from getting them. If both sides are willing to fork over it, then you wind up with two networks.”

Although Vet’s proposal garnered attention, it was met with skepticism from some within the community. Dark Horse, a notable community member, challenged the feasibility of the fork, pointing out that without agreement from the UNL (Unique Node List) validators, any changes would create a separate, isolated network that would be unable to interact with the main XRPL.

This scenario would result in the creation of a new, forked network rather than altering the existing one. Schwartz echoed these concerns, noting that validators have the autonomy to choose which version of the software they operate, meaning that any split would be driven by the code changes validators adopt. This highlights a crucial challenge of forking—ensuring enough validator support to create a functioning alternative to the original network.

An important consideration in any fork is whether it would gain the necessary support from exchanges and users. In the case of a split, similar to what occurred with Bitcoin and Bitcoin Cash, users could end up holding tokens on both networks.

However, the success of any forked version of XRP would depend on the willingness of exchanges and the broader community to support it. Without significant backing, a forked version of the token could struggle to gain traction.

Another issue brought up during the discussions was about the name “XRP” by a potential forked chain. Ripple CTO Schwartz mentioned that the XRPL Foundation holds the trademark for “XRP.”

While this wouldn’t prevent a fork, it could create legal and branding complications for the new network if it were to try to use the same name. This highlights how the XRPL ecosystem, while decentralized, still has certain centralized elements in terms of naming rights and trademarks.

It is important to know that validators, node operators, and exchanges play a critical role in determining the future of the network, and no single entity, not even Ripple or the XRPLF, has the authority to unilaterally enforce changes.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News

The crypto market is constantly changing, and meme coins are proving to be some of…

The legal standoff between Ripple and the U.S. Securities and Exchange Commission (SEC) appears to…

Meme coins are no longer just internet jokes—they’re full-fledged investment opportunities with communities that rival…

Recent reports indicate that Russia is increasingly using cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH),…

John Bollinger, the creator of the Bollinger Bands technical indicator, has praised XRP for its…

The price of Shiba Inu (SHIB) could experience a significant surge if it follows Bitcoin’s…