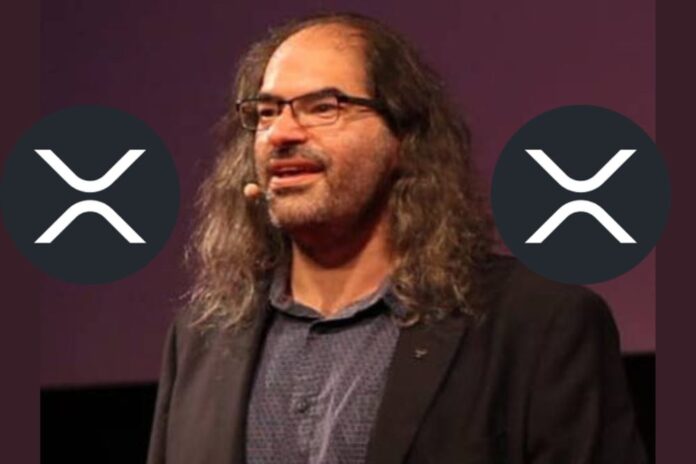

Ripple CTO, David Schwart, does not subscribe to tampering with the status of the XRP Ledger or manipulating transaction fees on the network to boost the price of XRP.

The prevailing low value of XRP has become a huge concern to many users and investors, leading to many suggestions on how to possibly boost the price of the 6th-largest crypto asset.

Accordingly, a certain user noted that the fees charged for using the carbon-neutral and highly scalable XRP Ledger network are extremely cheap. Hence, he suggested that transaction fees on the XRP Ledger should be modified in a way that would impact the price of its native token.

In addition, he said transaction fees should be charged based on the amount of value moved. That is, the higher the value moved, the higher the fees, and the lesser the value moved, the lower the transaction fees.

In his words, “The XRPL is too cheap! Burning transaction fees just doesn’t have enough impact to catapult #XRP to a double-digit price. Should there be an amendment to increase the fees by a factor that takes into account the value of the transaction? (More value ($) transferred = more fees?)”

Reacting to this, the Ripple Chief Technology Officer stressed that the selling point and what makes the XRP Ledger unique is the associated low cost of using the blockchain network.

Based on this, Schwartz doesn’t subscribe to the notion of gaming the network fees to inorganically influence the price of XRP.

“…I don’t think txn fee destruction should be used as an artificial mechanism to try to put upward pressure on XRP price. I think txn fees should reflect the actual cost a txn imposes on the network to more rationally allocate resources.”

I answered "yes", but I don't think txn fee destruction should be used as an artificial mechanism to try to put upward pressure on XRP price. I think txn fees should reflect the actual cost a txn imposes on the network to more rationally allocate resources.

— David "JoelKatz" Schwartz (@JoelKatz) March 5, 2023

He believes unduly increasing the XRPL network charges, which is less than one cent, could reduce the transaction completion time on the network.

“I don’t want to lose the advantage of low-cost, high speed transaction confirmation. But I also don’t think node operators should be subsidizing transactions whose value is less than their actual total cost,” he said.

But for a better allocation of resources, he supported that transaction fees should be amended to reflect the actual cost imposed by a transaction.

He wrote, “My thinking is that if the txn fee is less than the actual cost of a txn, then we’ll be destroying value by executing txns and discouraging people from running nodes. Whereas if the fee is more than the cost, we’re adding needless friction.”

XRP Price Expectations

XRP has indeed been underperforming of late but the asset is expected to move upward if the ongoing Ripple-SEC lawsuit ends in favor of the crypto solutions company.

According to Ripple General Counsel Stuart Alderoty, the summary judgment would come anytime soon, probably by the end of March 2023. This he said while outlining what Ripple would do if the judge gives a conclusion that favors the SEC.

Follow us on Twitter, Facebook, Telegram, and Google News