The question of what happens to XRP when it becomes widely adopted, resulting in increased transaction volumes and subsequent token destruction, is critical to understanding its future.

As XRP is burned with each transaction, concerns arise about the potential scarcity of the token and how this might affect its usability in the long term.

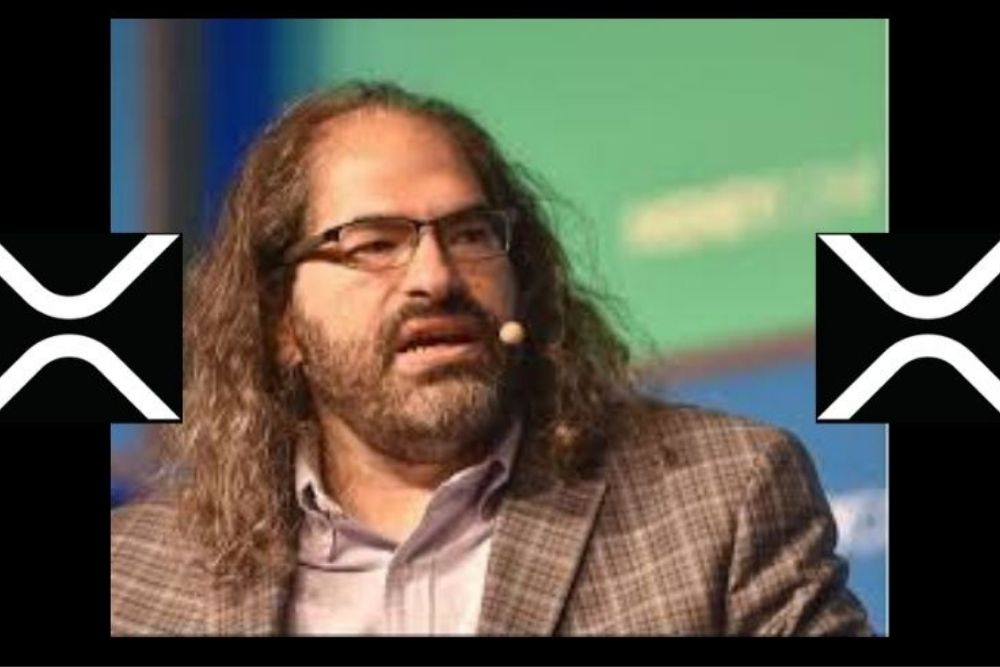

Edoardo Farina, CEO of Alpha Lions Academy, recently shared comments from David Schwartz, the Chief Technology Officer of Ripple, addressing these concerns.

Schwartz discussed possible outcomes if XRP becomes scarce to the point where its smallest unit, a drop (one-millionth of an XRP), becomes too valuable to facilitate transactions effectively.

The XRP community does not burn tokens to raise its price like SHIB, but the reduced supply from fees could impact it over time as the price increases. According to Farina, Schwartz outlines three primary solutions to this potential issue.

The first possibility is that the XRP community could agree to increase the divisibility of XRP. This change would be implemented through a software update, allowing for smaller subdivisions of XRP, making it more flexible and usable even if its overall supply diminishes significantly. This solution could be a straightforward way to maintain the functionality of XRP as a medium of exchange.

The second potential solution involves altering the way transaction fees are structured. Currently, fees are calculated in drops per transaction. If XRP became too scarce, the community could agree to switch the metric to transactions per drop.

This would mean that rather than each transaction costing a specific amount of drops, a single drop could cover multiple transactions. This approach offers a way to mitigate the impact of scarcity by spreading the cost of transactions over fewer units of XRP.

The final solution is more complex, as it requires the creation of a new asset called “transaction credits.” These credits would be introduced with a zero balance for all users and priced at one trillionth of an XRP.

If a transaction required more credits than a user possessed, the necessary amount of XRP drops could be converted into transaction credits at a predetermined rate, for example, one million drops to one transaction credit.

This system would effectively decouple the transaction costs from the direct use of XRP, thus preserving XRP’s value while still facilitating transactions.

The issue of XRP scarcity due to high transaction volumes is not an insurmountable challenge. With predictions as high as $1,000 and more, the XRP community and broader financial landscape might need to implement one of these solutions soon.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News

Crypto entrepreneur Yassin Mobarak (@Dizer_YM) has drawn attention to the possibility that the U.S. government…

By Chainfocus on March 7, 2025 I Market Insights The cryptocurrency market is heating up…

Crypto influencer Amelie (@_Crypto_Barbie) recently reinforced a long-standing belief within the XRP community that XRP…

Pepe Coin (PEPE) has tumbled to $0.0000073, marking an 18% drop and raising concerns that…

With 80% of Japanese banks gearing up for integration, Ripple’s XRP continues to make power…

By Trend Tracker on March 8 2025 | Market Insights The race for blockchain dominance…