The topic of the XRPL-based crypto token being utilized as collateral recently erupted again, courtesy of Jimmy Vallee, the managing director of Valhil Capital.

It bears noting that Vallee proposed a buyback theory for XRP in 2021 following his big assumption that XRP would become the world’s reserve currency in the future.

Back then, he submitted that governments would have to buy back the Ripple digital token at an agreed fixed price in the confines of $37,500 and $50,000 per XRP.

While the debate over these claims continues, Vallee resurfaced last week with another version of the XRP buyback theory. This time around, he suggested that XRP holders should channel their holdings to a bank he called ‘People’s Bank’ and employ them as collateral for loans.

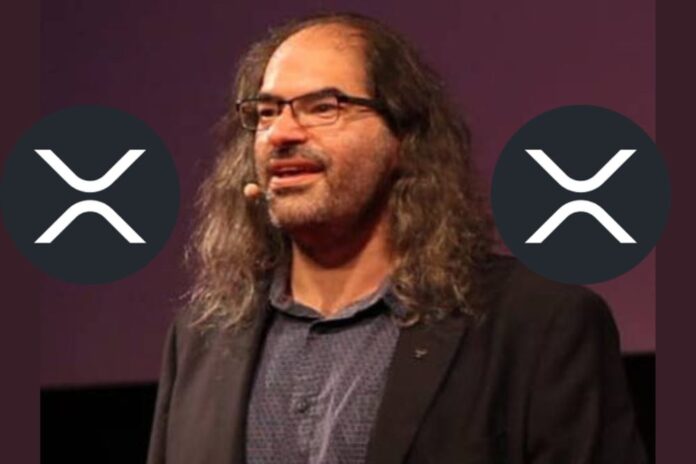

Ripple CTO agrees on XRP is a good collateral instrument

Reacting to this notion aired by Vallee in a Thursday interview session, Ripple Chief Technology Officer David Schwartz made a case for XRP’s viability and value as collateral for loans.

In particular, Schwartz submitted that XRP is liquid and could make a good collateral instrument just like land, stocks, and gold.

“If you asked someone to explain why stocks make good collateral for loans, the number one reason would be that they’re liquid. I’d be surprised if anything about possible issuer buybacks or redemption would even be on the list.”

To buttress his assertion, he highlighted three core factors that prove that XRP has value to borrow or lend against.

“Factors that make XRP good collateral is its proven history of liquidity and reliable price discovery. The biggest negative of using XRP for collateral is its volatility which means you need either overcollateralization, other assurances of payment, or have to charge high rates.”

If you asked someone to explain why stocks make good collateral for loans, the number one reason would be that they're liquid. I'd be surprised if anything about possible issuer buybacks or redemption would even be on the list.

— David "JoelKatz" Schwartz (@JoelKatz) March 26, 2023

On the contrary, a certain user named Rippleitin.nz countered both Vallee and Schwartz, arguing that XRP would fail as a collateral option given its price instability, and lack of inherent and redemption value.

He wrote, “To work as collateral an asset has to have a redemption value. If you own XRP is has no inherent value – Only a buyer can give it value and only for the time it is transit – 3.5 seconds approx. the new owner needs a buyer to give it value.”

“Gold is mined – somebody does some work and adds that value to gold. XRP could be used as collateral but because it has no inherent/stable value, and is very volatile in its price, the risk is extremely high that the collateral may not cover the loan. A loan sharks dream, ” Rippleitin.nz added.

In reaction, Schwartz pointed out that both stocks and dollars have no redemption value — a price at which an issuing company can repurchase stock before maturity — yet they are commonly used as collateral. “If you mean some guarantee of value, stocks don’t have that. They are routinely used as collateral,” he wrote.

On the other hand, he noted that “1 XRP can be redeemed for 1 XRP on the ledger just as much as 1 dollar can be redeemed from 1 dollar from the government.”

1 XRP can be redeemed for 1 XRP on the ledger just as much as 1 dollar can be redeemed from 1 dollar from the government. If you mean some guarantee of value, stocks don't have that. They are routinely used as collateral.

— David "JoelKatz" Schwartz (@JoelKatz) March 26, 2023

Although Schwartz agrees with Vallee’s latest stance on the XRP buyback theory, the Ripple CTO dubbed his former theory a scam.

Follow us on Twitter, Facebook, Telegram, and Google News