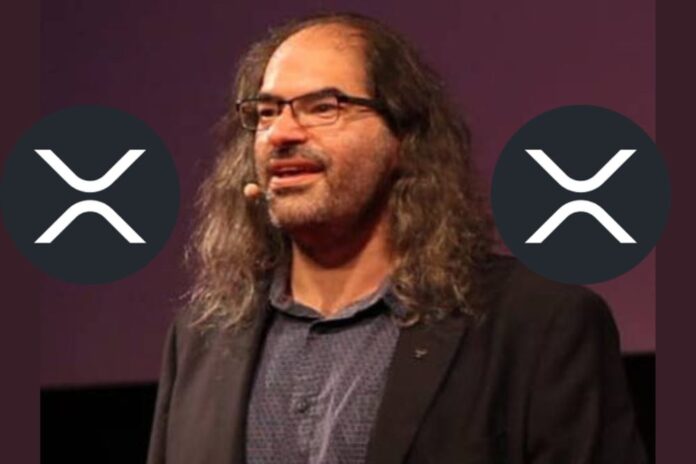

In a frank and introspective look back at his past investment choices, David Schwartz, Ripple’s Chief Technology Officer, shared insights into a choice that continues to haunt him. Engaging with the community on X, Schwartz emphasized the importance of maintaining personal integrity, noting that his most profound regrets stem from when he compromised his standards to match others.

This introspective discussion led to a broader conversation about investment choices, where Schwartz disclosed a significant financial decision from his past. He revealed that he had sold 40,000 Ethereum (ETH) at approximately $1.05 each, a decision he now regards as a notable misstep in his cryptocurrency journey.

Early Involvement with Ethereum

Schwartz’s engagement with Ethereum dates back to its inception. Invited by Ethereum co-founder Vitalik Buterin, Schwartz participated in the project’s initial coin offering (ICO). Demonstrating support for the nascent platform, he invested 20 Bitcoin (BTC), acquiring 40,000 ETH in return. At that time, this exchange was valued at approximately $12,400.

Despite his early support, Schwartz sold his ETH holdings when the price reached around $1 per token. The proceeds from this sale were used to purchase solar panels for a property he no longer owns. Reflecting on this choice, Schwartz acknowledges the substantial financial gains he missed, given ETH’s subsequent appreciation.

Perspectives on Risk Management

Schwartz decided to sell his Ethereum (ETH) holdings as part of a broader risk management strategy. In discussions with his wife around 2012, they agreed to reduce exposure to volatile assets. This approach led to the sale of various cryptocurrencies, including Bitcoin and XRP, at prices that, in hindsight, were significantly lower than their current valuations.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Current Holdings and Transparency

Throughout his tenure in the cryptocurrency space, Schwartz has maintained a commitment to transparency regarding his asset holdings. He has disclosed that, at the peak of his investments, he held approximately 26 million XRP. Notably, he stated that he has never sold XRP to acquire other cryptocurrencies, underscoring his confidence in Ripple’s native token.

Insights from Industry Peers

Schwartz’s experiences echo a common theme among early cryptocurrency adopters: the challenge of balancing support for emerging technologies with prudent financial management. His reflections offer valuable lessons on the unpredictable nature of digital asset markets and the importance of aligning investment decisions with personal values and risk tolerance.

In sharing his story, Schwartz provides a nuanced perspective on the complexities of cryptocurrency investment, highlighting the interplay between foresight, risk management, and the evolving landscape of digital finance.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News