There is a debate in the XRP community, centered around a new initiative proposed by Evernode co-founder Scott Chamberlain. Chamberlain’s proposal aims to enhance transaction functionality on the XRP Ledger (XRPL) while maintaining cost-effectiveness for users. The initiative highlights two primary components:

The first is Hooks, a flexible, low-cost system designed to support decentralized applications on the XRPL. Hooks have already demonstrated their efficacy through projects like Evernode, where they automate crucial tasks such as registration, reputation scoring, and governance for network hosts.

The second part of Chamberlain’s proposal is Codii, a new native token that would be minted from locked XRP. The purpose of Codii is to serve as a medium for paying Hook-related fees, potentially reducing the financial burden on users compared to directly burning XRP for smart contract operations.

The Rationale Behind the Proposal

According to Chamberlain, the introduction of Codii addresses a significant concern: the potential for smart contracts to become prohibitively expensive if the value of XRP appreciates significantly. By implementing Codii, the proposal aims to create a self-sustaining system where XRP holders could effectively cover Hook fees through inflationary balance adjustments.

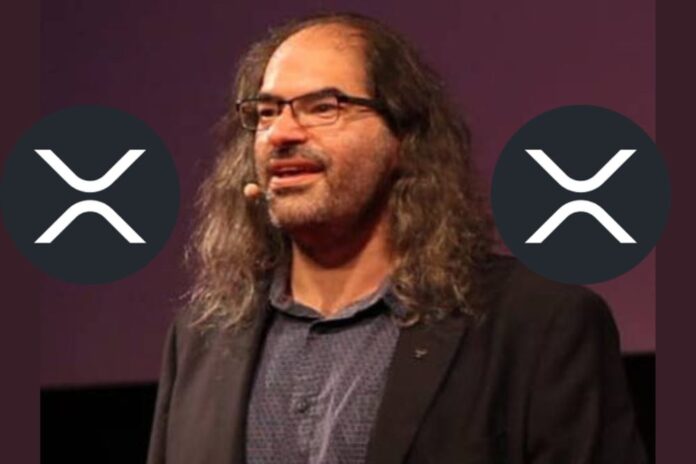

The proponents of this initiative argue that it offers a more nuanced approach to transaction fee management, potentially making the XRPL more attractive for complex decentralized applications. However, Chamberlain’s recommendations were met with skepticism from Ripple’s Chief Technology Officer, David Schwartz, and other prominent voices in the community.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Ripple CTO’s Counterarguments

Schwartz has expressed reservations about the necessity and efficacy of such a complex system. One major concern is increased complexity. The introduction of Codii would require users and the system to manage two tokens instead of one, potentially complicating operations.

XRP holders might also face dilution losses due to the minting of Codii from locked tokens. Schwartz also argues that the system simply equates to burning XRP for all transaction fees.

Notably, Vet, an XRPL validator, offered a critical perspective on the proposed initiative. Vet also questions the necessity of implementing Evernode on the XRPL, given its successful operation on Xahau. He argued that the introduction of a new token like Codii may not provide significant benefits.

According to Vet, locking up XRP to issue a new token that is subsequently burned as gas effectively renders the locked XRP permanently unusable, similar to burning it directly. This raises the question of why the digital asset itself couldn’t be used as gas for smart contract operations.

Furthermore, Vet contends that the concern over high fees for contract executions is overstated, noting that these costs are typically fractions of a penny and not significant enough to warrant major system changes.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News