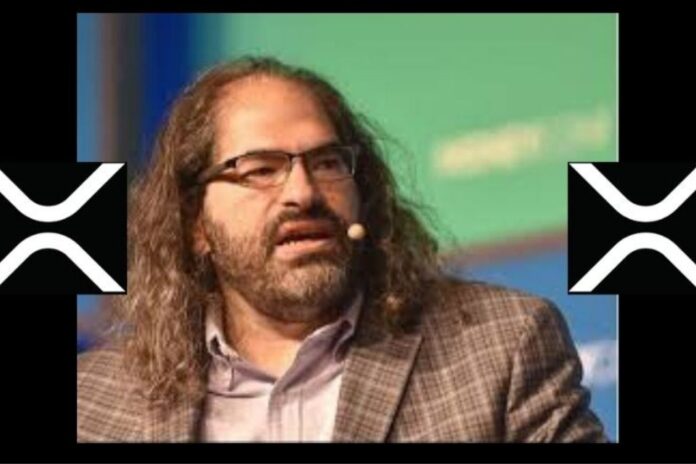

At the recent CoinDesk Consensus 2024 conference, Ripple’s Chief Technology Officer, David Schwartz, provided insights into the company’s recently announced roadmap for integrating large institutions into the decentralized finance (DeFi) space.

Schwartz emphasized that Ripple’s strategy aims to enable traditional financial institutions to create and offer regulated financial products that can seamlessly interact with DeFi ecosystems. He explained that this could involve tokenizing traditional assets like loans and securities, allowing them to be traded and managed within DeFi platforms.

Read Also: XRP Price Primed for Parabolic Surge as Analyst Spots 1000% Golden Cross: Details

Drawing Parallels with the Internet’s Growth

Schwartz highlighted the importance of institutional adoption for widespread crypto adoption, drawing an analogy with the early days of the internet. He pointed out that the internet’s initial growth was driven by government and military use, ultimately leading to broader public adoption. Similarly, Schwartz believes institutional involvement is crucial for the mainstream acceptance and expansion of DeFi.

In this context, Schwartz emphasized the suitability of the XRP Ledger, Ripple’s blockchain platform, for these types of applications due to its inherent features and capabilities.

Shifting Focus from Transactions to User Adoption

Schwartz acknowledged that Ripple’s initial focus on having institutions adopt its payment technology, such as using XRP for transactions, did not translate directly into user adoption. While banks and other institutions were using Ripple’s solutions, their customers remained largely unaware of the underlying blockchain technology.

Schwartz pointed to the widespread adoption of stablecoins like USDT as evidence of the growing institutional interest in crypto. He noted that these stablecoins, despite their institutional nature, play a vital role in fueling decentralized economies.

Schwartz expressed optimism about the current trend of institutions not only adopting blockchain technology but also actively bringing their customers onto the blockchain or enabling them to participate in blockchain-based activities.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Read Also: Analyst Says XRP Could Hit $5 to $10 this Bull Cycle. Here’s why

Addressing Regulatory Concerns

Schwartz also addressed concerns about regulatory hurdles, emphasizing that it is possible to have thoroughly regulated assets like tokenized securities or loan portfolios within DeFi. These assets can be subject to rigorous KYC and AML processes, ensuring compliance, while the underlying tokens representing ownership or collateral can remain fully decentralized.

Overall, David Schwartz’s insights shed light on Ripple’s strategic approach to fostering DeFi adoption. By attracting and enabling institutions to participate, Ripple aims to bridge the gap between traditional finance and the decentralized world, paving the way for broader user adoption and mainstream acceptance of DeFi.

Follow us on Twitter, Facebook, Telegram, and Google News